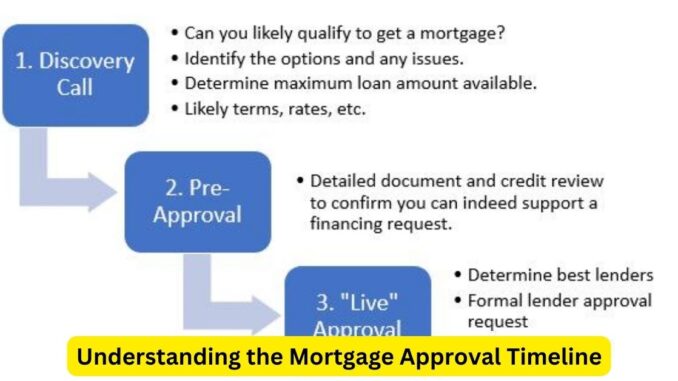

The mortgage approval process involves several steps, each contributing to a comprehensive timeline that aspiring homeowners should understand before embarking on their homeownership journey:

Pre-Approval Stage: Before house hunting, it’s advisable to seek pre-approval from a lender. This step typically involves providing financial information for a preliminary assessment of your borrowing capacity. Pre-approval helps determine a budget and shows sellers you’re a serious buyer.

House Hunting and Offer Submission: Once pre-approved, the house hunting phase begins. When you find the right property, you’ll make an offer. Upon acceptance, the purchase agreement is finalized, initiating the mortgage application process.

Mortgage Application: After your offer is accepted, you’ll officially apply for a mortgage. This involves submitting detailed financial information, such as bank statements, tax returns, and employment verification, to the lender.

Processing and Underwriting: Once the application is submitted, the lender begins processing the loan. This phase involves verifying the provided information, assessing the property’s value through an appraisal, and reviewing your creditworthiness. The underwriter evaluates the risk associated with the loan and ensures it meets lending criteria.

Conditional Approval and Closing Disclosure: After processing and underwriting, the lender issues a conditional approval, listing any outstanding conditions needed to finalize the loan. Concurrently, they provide a Closing Disclosure, detailing loan terms, closing costs, and any additional information about the loan.

Clearing Conditions and Final Approval: You’ll need to satisfy any outstanding conditions outlined in the conditional approval. This might involve providing additional documents or explanations to the lender. Once all conditions are met, the lender grants final approval for the mortgage.

Closing and Funding: The closing date is scheduled, and both parties—buyer and seller—sign numerous documents, including the mortgage note and deed of trust. Simultaneously, the lender funds the loan, and ownership of the property transfers to the buyer.

Timeline Factors and Considerations:

- Complexity of Application: Complicated financial situations or documentation requirements might prolong the process.

- Market Conditions: Busy real estate markets can lead to delays due to high demand for appraisers and underwriters.

- Communication and Responsiveness: Promptly providing requested documents and responding to inquiries expedites the process.

Tips to Expedite the Process:

- Organize Financial Documents: Have all necessary financial documents ready to streamline the application process.

- Stay in Contact: Maintain open communication with your lender and promptly respond to requests for information.

- Avoid Financial Changes: Refrain from making significant financial moves, like changing jobs or acquiring new debts, during the approval process.

Realistic Expectations: While some transactions might move swiftly, others might encounter delays. Expecting an average timeline of 30 to 45 days from application to closing is reasonable, but variations are common.

Understanding the mortgage approval timeline empowers buyers to navigate the process more confidently. By staying organized, responsive, and proactive, prospective homeowners can facilitate a smoother and more efficient journey toward homeownership.

Leave a Reply