Tank Stars Mod APK v2.17.100 – Unlimited Coins & Unlocked Weapons

Tank Stars is a turn-based artillery game developed by Playgendary that blends tactical combat with explosive physics-based mechanics. The game allows players to control heavily […]

Tank Stars is a turn-based artillery game developed by Playgendary that blends tactical combat with explosive physics-based mechanics. The game allows players to control heavily […]

FC Mobile is the mobile version of the famous FIFA football game series. It brings fast, fun, and realistic football action to your phone. The […]

What Are Mutual Funds and How Do They Work? A mutual fund is a pooled investment vehicle where money from multiple investors is collected and […]

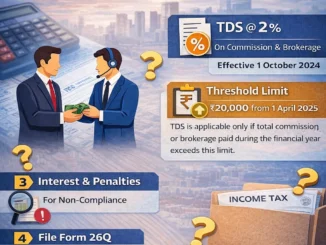

Navigating the complexities of the Indian taxation framework requires a clear understanding of the various Tax Deducted at Source (TDS) provisions. Among these, Section 194H […]

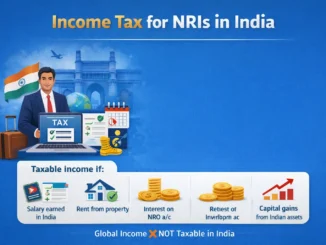

Taxation of Non-Resident Indians (NRIs) in India is governed by the Income Tax Act, 1961. The tax liability of an individual depends primarily on their […]

What’s New in Minecraft Bedrock 26.10.23 Great news for Minecraft fans! Mojang just dropped something exciting. The latest Minecraft Bedrock 26.10.23 beta and preview was […]

First of all, the Minecraft Bedrock 26.0 update is now available globally. Additionally, it introduces overhauls to baby mobs significantly. Moreover, it includes addition of […]

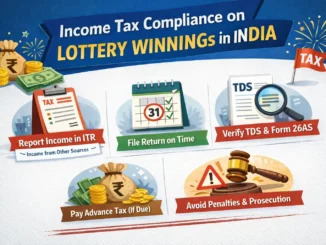

Winning a lottery can be exciting and life-changing, but it also comes with important tax implications. In India, lottery winnings are taxed at a special […]

GSTR-9 is an annual return that regular taxpayers registered under GST must file once for every financial year. It is a consolidated summary of all […]

Free Fire players always look for new ways to get premium items. These items include diamonds, rare bundles, legendary emotes, and max-level gun skins. Moreover, […]

Copyright © 2026 | WordPress Theme by MH Themes