In the realm of real estate financing, jumbo mortgages stand tall as a specialized solution for high-value property purchases. These loans cater to buyers eyeing properties beyond conventional loan limits, providing access to substantial funds for acquiring luxury homes or properties in high-cost areas.

A jumbo mortgage differs from conventional mortgages primarily in the loan amount. While conventional mortgages adhere to the limits set by government-sponsored entities like Fannie Mae and Freddie Mac, jumbo mortgages surpass these limits. In most parts of the United States, a loan exceeding $548,250 (as of 2021) qualifies as a jumbo mortgage, though these thresholds can vary based on location and market dynamics.

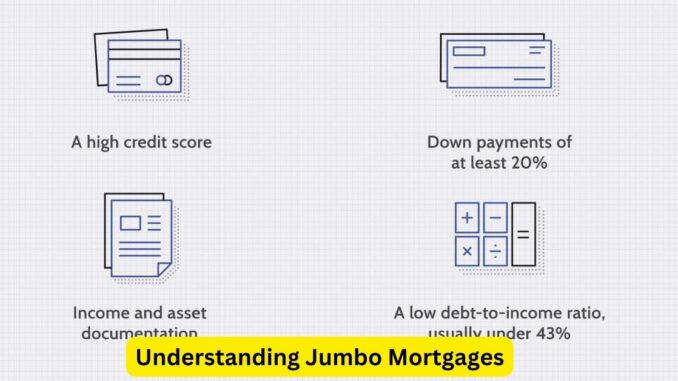

One defining feature of jumbo mortgages is their sizeable loan amounts, enabling buyers to invest in prestigious properties. However, this additional flexibility comes with stricter lending criteria. Borrowers seeking jumbo mortgages typically face more rigorous approval processes compared to conventional loans. Lenders evaluate not just creditworthiness but also require larger down payments and proof of substantial income to mitigate the higher risk associated with these sizable loans.

Interest rates on jumbo mortgages often differ from those on conventional loans. Due to the increased risk for lenders, rates for jumbo mortgages may be slightly higher. However, these rates can fluctuate based on market conditions and the lender’s policies. Borrowers can explore various options, including fixed-rate and adjustable-rate jumbo mortgages, to find the most suitable terms for their financial situation.

Another aspect to consider with jumbo mortgages is the impact of economic fluctuations. High-value properties may experience different market behaviors compared to more standard residential properties. Economic volatility can influence the rates and terms offered by lenders, making it crucial for buyers to assess market conditions before committing to a jumbo mortgage.

Despite the stringent criteria and potentially higher interest rates, jumbo mortgages offer unique advantages. They facilitate the acquisition of larger or luxurious properties that may not be accessible through conventional financing. Moreover, for individuals with strong financial profiles and a clear repayment plan, jumbo mortgages can be a strategic investment tool.

Navigating the complexities of jumbo mortgages requires careful consideration and expert guidance. Prospective buyers should consult with experienced mortgage professionals to understand the nuances, weigh the financial implications, and make informed decisions aligned with their long-term goals.

In essence, jumbo mortgages represent a specialized avenue in real estate financing, catering to the aspirations of buyers seeking high-value properties. While they come with stricter requirements and potential variations in interest rates, these loans open doors to owning prestigious homes that might otherwise remain out of reach.

Leave a Reply