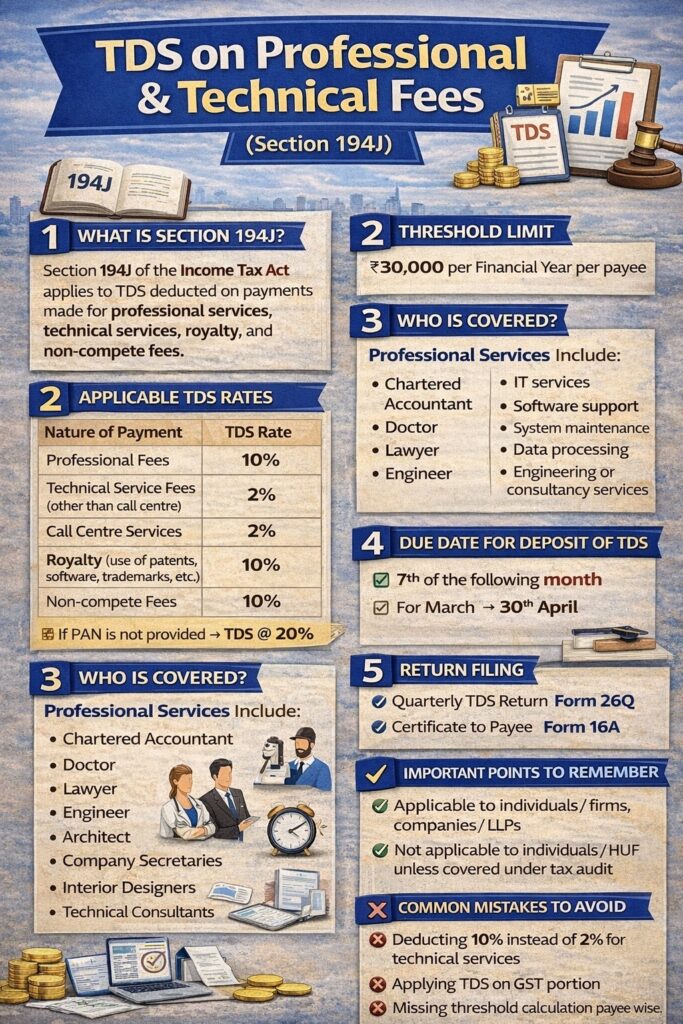

What is Section 194J?

Section 194J of the Income Tax Act applies to TDS deducted on payments made for professional services, technical services, royalty, and non-compete fees.

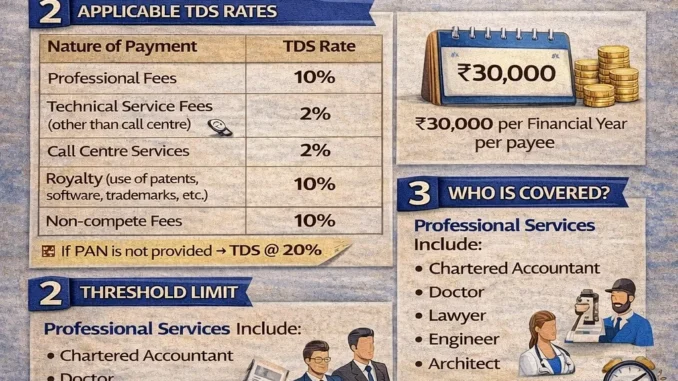

Applicable TDS Rates

| Nature of Payment | TDS Rate |

|---|---|

| Professional Fees | 10% |

| Technical Service Fees (other than call centre) | 2% |

| Call Centre Services | 2% |

| Royalty (use of patents, software, trademarks, etc.) | 10% |

| Non-compete Fees | 10% |

# If PAN is not provided → TDS @ 20%

When is TDS deducted?

TDS must be deducted at the earlier of:

- Credit to the account of the payee, or

- Actual payment (cash / cheque / bank transfer)

Threshold Limit (No TDS if below)

- ₹30,000 per financial year per payee

Who is Covered?

Professional services include:

- Chartered Accountants

- Doctors

- Lawyers

- Engineers

- Architects

- Company Secretaries

- Interior Designers

- Technical Consultants

Technical services include:

- IT services

- Software support

- System maintenance

- Data processing

- Engineering or consultancy services

Due Date for Deposit of TDS

- 7th of the following month

- For March → 30th April

Return Filing

- Quarterly TDS Return – Form 26Q

- Certificate to payee → Form 16A

Who is responsible for deducting TDS under Section 194J?

General Rule

Any person (payer) who makes payment for professional fees, technical fees, royalty, or non-compete fees is responsible to deduct TDS under Section 194J, except certain individuals/HUFs.

Persons Required to Deduct TDS

# Mandatory Deductors

- Company

- Partnership Firm / LLP

- Trust

- Association of Persons (AOP)

- Body of Individuals (BOI)

- Cooperative Society

- Local Authority

- Artificial Juridical Person

*These entities must deduct TDS irrespective of turnover

# Individual / HUF

An individual or HUF is required to deduct TDS ONLY IF:

- They are liable to a tax audit under Section 44AB in the preceding financial year.

*If not liable to a tax audit, then no TDS obligation under Section 194J.

Persons NOT Required to Deduct TDS

- Individual/HUF not covered under tax audit

- Personal payments (not related to business/profession)

- Payments below threshold limit (₹30,000 per payee per year)

Important Clarifications

- TDS is deducted at the time of credit or payment, whichever is earlier

- Responsibility lies with the payer, not the service provider

- PAN of payee is mandatory, else TDS @ 20%

Quick Summary Table

| Payer Type | TDS u/s 194J Required? |

|---|---|

| Company | Yes |

| Firm / LLP | Yes |

| Trust / Society | Yes |

| Individual / HUF (Tax Audit) | Yes |

| Individual / HUF (No Tax Audit) | No |

Example

- A company pays ₹1,00,000 to a CA → TDS applicable

- An individual (not under audit) pays a doctor for business advice → No TDS

- An individual under tax audit pays a software consultant → TDS applicable

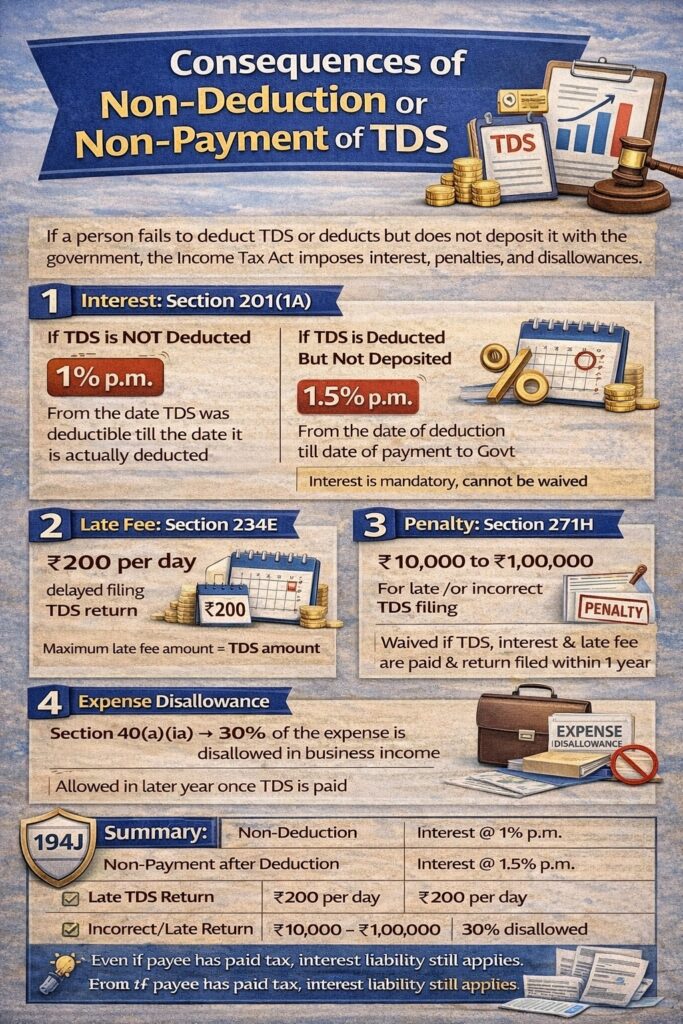

Consequences of Non-Deduction or Non-Payment of TDS

If a person fails to deduct TDS or deducts but does not deposit it with the government, the Income Tax Act imposes interest and penalties. Under Section 201(1A), interest is charged at 1% per month or part of a month from the date TDS was deductible till the date it is actually deducted. If TDS is deducted but not deposited, interest is charged at 1.5% per month or part of a month from the date of deduction till the date of payment. In addition to interest, a late fee of ₹200 per day is levied under Section 234E for delay in filing the TDS return, subject to a maximum of the TDS amount.

A penalty under Section 271H, ranging from ₹10,000 to ₹1,00,000, may also be imposed for late filing or incorrect TDS returns, though it can be waived if TDS, interest, and the late fee are paid and the return is filed within one year.

Further, under Section 40(a)(ia), 30% of the expense on which TDS was not deducted or paid is disallowed while computing business income, although the expense is allowed in a later year once TDS compliance is completed.

FAQs: TDS on Professional & Technical Fees

Q1. What is Section 194J?

Answer:

Section 194J deals with Tax Deducted at Source (TDS) on payments made for professional services, technical services, royalty, and non-compete fees.

Q2. What payments are covered under Section 194J?

Answer:

Payments covered include:

- Professional fees

- Technical service fees

- Royalty (software, patents, trademarks, copyrights, etc.)

- Non-compete fees

Q3. What is the TDS rate under Section 194J?

Answer:

| Nature of Payment | TDS Rate |

|---|---|

| Professional fees | 10% |

| Technical services (incl. call centre) | 2% |

| Royalty | 10% |

| Non-compete fees | 10% |

# If PAN is not provided, TDS is deducted at 20%.

Q4. What is the threshold limit under Section 194J?

Answer:

TDS is applicable only if total payment exceeds ₹30,000 in a financial year per payee.

Q5. Who is required to deduct TDS under Section 194J?

Answer:

All entities such as companies, firms, LLPs, trusts, and tax-audit applicable individuals/HUFs must deduct TDS.

Individuals/HUFs not liable to tax audit are not required to deduct TDS.

Q6. When should TDS be deducted under Section 194J?

Answer:

TDS must be deducted at the earlier of:

- Credit of amount to payee’s account, or

- Actual payment

Q7. Is TDS applicable on the GST portion of the invoice?

Answer:

No. GST is excluded from TDS, provided it is shown separately in the invoice.

Q8. What are the due dates for depositing TDS?

Answer:

- 7th of the following month

- For March payments → 30th April

Q9. Which TDS return is filed for Section 194J?

Answer:

- Quarterly return: Form 26Q

- TDS certificate: Form 16A

Q10. What happens if TDS is not deducted or deposited?

Answer:

The payer may be liable for:

- Interest under Section 201(1A)

- Late fee under Section 234E

- Penalty under Section 271H

- Disallowance of expense under Section 40(a)(ia)

Q11. Is Section 194J applicable to personal payments?

Answer:

No. TDS under Section 194J applies only to business or professional payments, not personal expenses.

Q12. What are common mistakes under Section 194J?

Answer:

- Applying 10% instead of 2% for technical services

- Deducting TDS on GST amount

- Ignoring PAN non-availability

- Missing the ₹30,000 threshold calculation

Q13. Can TDS be reduced or not deducted at all?

Answer:

Yes. The payee may apply for a lower or nil TDS certificate under Section 197.

Leave a Reply