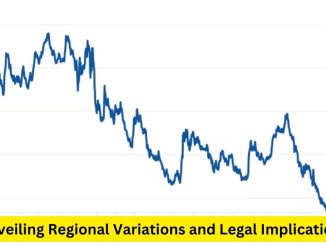

Navigating the Waves: Legal Ethics in Mortgage Rate Fluctuations and Economic Policy

The intersection of mortgage rate fluctuations and economic policy presents a complex landscape where legal ethics play a pivotal role. This article explores the ethical […]