Navigating Generational Waves: Mortgage Rate Sensitivity and Homebuyer Behavior

The ebb and flow of mortgage rates have a profound impact on the behavior of homebuyers, with distinct patterns emerging across different generations. This article […]

The ebb and flow of mortgage rates have a profound impact on the behavior of homebuyers, with distinct patterns emerging across different generations. This article […]

As mortgage rates continue to ebb and flow, legal professionals find themselves at the nexus of financial expertise and ethical considerations in the realm of […]

In the dynamic landscape of real estate, the concept of mortgage rate transparency has emerged as a pivotal aspect of informed decision-making for homebuyers. As […]

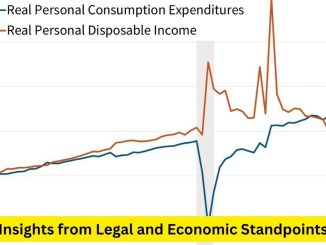

Forecasting mortgage rates involves a complex interplay between legal regulations and economic indicators, influencing both lenders and borrowers. Understanding this intricate relationship is crucial for […]

In the realm of mortgage lending, transparency in disclosing interest rates stands as a fundamental legal right for borrowers. Mortgage rate transparency ensures that borrowers […]

Copyright © 2026 | WordPress Theme by MH Themes