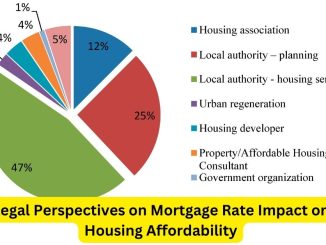

Balancing Act: Legal Perspectives on Mortgage Rate Impact on Housing Affordability

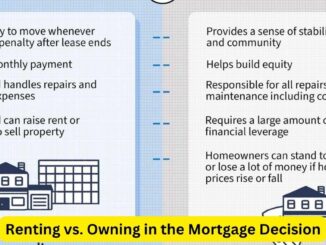

The intersection of mortgage rates and housing affordability is a critical consideration in the real estate landscape, impacting prospective homeowners, lenders, and legal professionals alike. […]