Navigating the complexities of the Indian taxation framework requires a clear understanding of the various Tax Deducted at Source (TDS) provisions. Among these, Section 194H of the Income-tax Act, 1961 plays a significant role for businesses and individuals involved in transactions that include the payment of commission or brokerage to agents, intermediaries, or distributors.

This provision governs the deduction of TDS on commission or brokerage payments and is particularly relevant for businesses paying real estate agents, sales representatives, marketing intermediaries, or channel partners. A sound understanding of the applicable rate, threshold limits, and compliance requirements is essential to ensure smooth financial operations and avoid regulatory exposure.

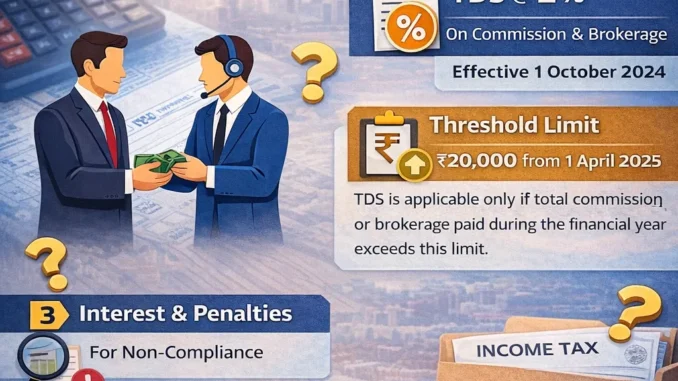

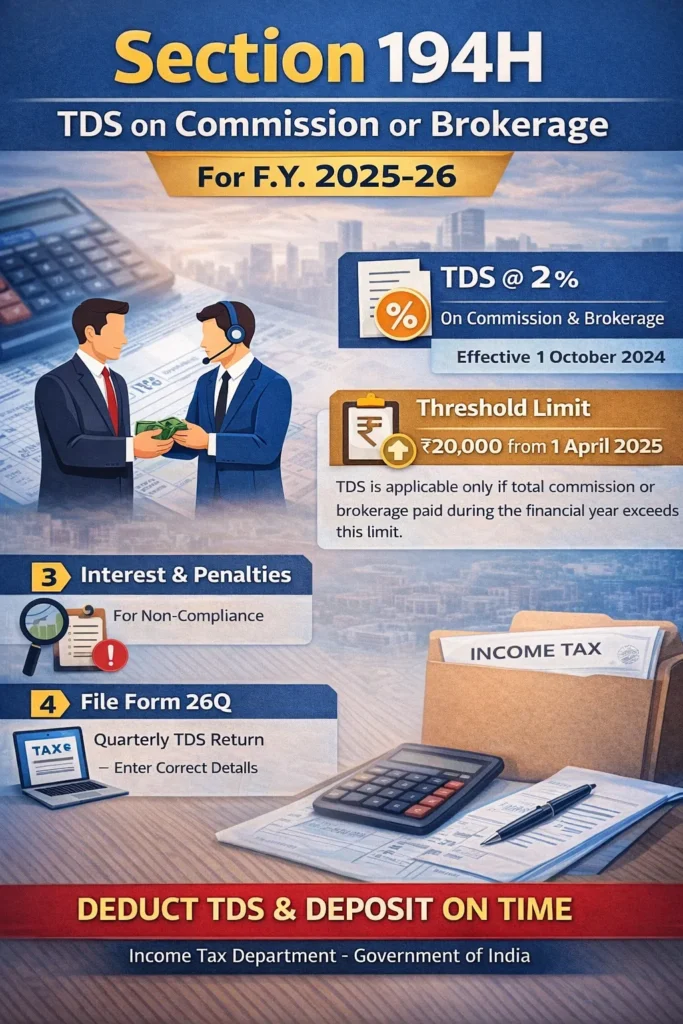

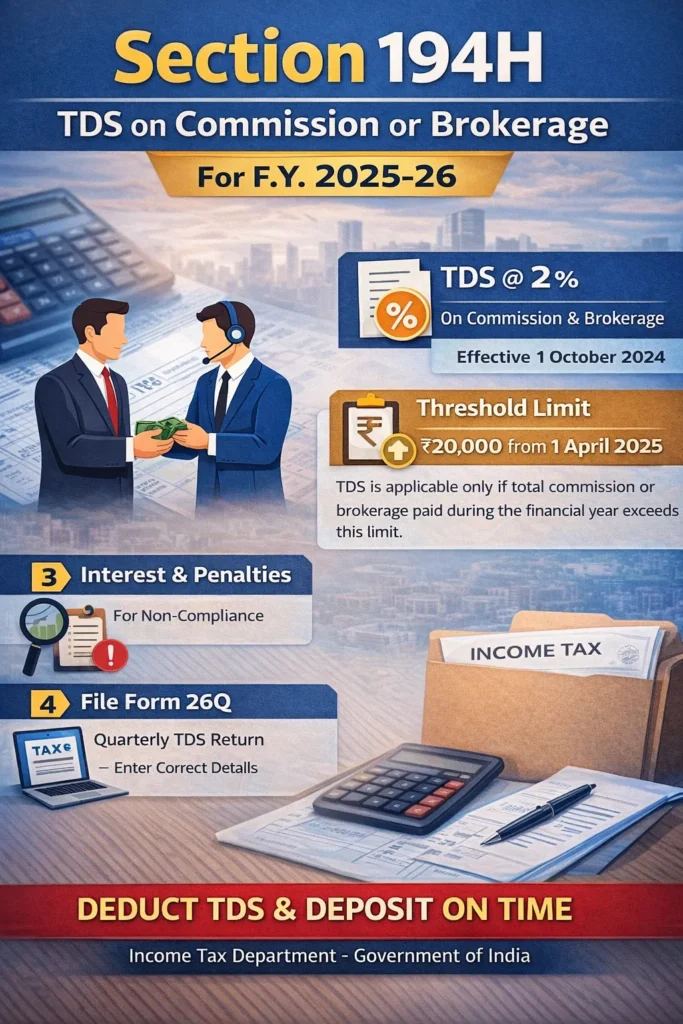

Key Update – Union Budget 2024

In line with the government’s objective of simplifying the tax structure and easing compliance for taxpayers, the Union Budget 2024 introduced important amendments to Section 194H:

- TDS rate reduction: The TDS rate has been reduced from 5% to 2%, and this reduction came into effect from 1 October 2024. This applies to commission and brokerage payments to resident taxpayers, easing the immediate financial impact on both businesses and intermediaries.

- Threshold limit increase: In addition to lowering the rate, the threshold for deducting TDS under Section 194H has been raised from ₹15,000 to ₹20,000, effective 1 April 2025. This means TDS will be required only when total commission or brokerage paid to a person in a financial year exceeds ₹20,000, reducing compliance requirements on smaller transactions

Who is Liable to Deduct TDS under Section 194H?

Under Section 194H of the Income-tax Act, 1961, the responsibility to deduct TDS arises on the person making payment of commission or brokerage to a resident.

Persons Liable to Deduct TDS

The following persons are required to deduct TDS under Section 194H:

1. Companies

All companies (private or public) paying commission or brokerage must deduct TDS.

2. Partnership Firms / LLPs

Firms and Limited Liability Partnerships making commission payments are liable to deduct TDS.

3. Individuals and HUFs (Subject to Tax Audit)

Individuals or Hindu Undivided Families are required to deduct TDS only if they were liable for tax audit under Section 44AB in the preceding financial year.

# If an individual or HUF is not liable for a tax audit, then Section 194H does not apply to them.

Conditions for Applicability

TDS under Section 194H must be deducted if:

- The payment is in the nature of commission or brokerage.

- The payment is made to a resident.

- The aggregate amount exceeds the prescribed threshold during the financial year.

- The payment is credited or paid, whichever is earlier.

Important Note

- The deductor must obtain a TAN (Tax Deduction and Collection Account Number).

- TDS returns must be filed in Form 26Q.

- TDS certificate must be issued in Form 16A.

Failure to comply may attract interest and penalties from the Income Tax Department.

When is TDS Not Deductible under Section 194H?

Under Section 194H of the Income-tax Act, 1961, TDS is required on commission or brokerage payments to residents. However, there are specific situations where TDS is not applicable.

1. Payment Does Not Exceed the Threshold Limit

TDS is not required if the aggregate commission or brokerage paid or credited during the financial year does not exceed the prescribed limit:

- ₹15,000 (up to FY 2024–25)

- ₹20,000 (proposed from April 1, 2025, as per Union Budget 2024)

2. Payment to Non-Resident

Section 194H applies only to payments made to residents.

If commission is paid to a non-resident, TDS provisions of Section 195 of the Income-tax Act, 1961 apply instead.

3. Individual or HUF Not Liable for Tax Audit

If the payer is an individual or HUF and was not liable for tax audit under Section 44AB in the preceding financial year, TDS under Section 194H is not required.

4. Insurance Commission

Commission paid for procuring insurance business is covered under Section 194D of the Income-tax Act, 1961, not Section 194H.

5. Commission Paid by RBI

Commission paid by the Reserve Bank of India is excluded from the applicability of Section 194H.

6. Transactions Not in the Nature of Commission or Brokerage

If the payment is not in the nature of commission or brokerage (for example, trade discounts allowed in principal-to-principal transactions), TDS may not apply.

How to Calculate and Deposit TDS under Section 194H

Proper compliance with Section 194H of the Income-tax Act, 1961 is essential for businesses and individuals making commission or brokerage payments. Timely deduction and deposit of TDS not only ensure smooth financial operations but also help avoid interest, penalties, and disallowance of expenses. Below is a clear step-by-step guide to calculating and depositing TDS under this section.

Step 1: Verify Applicability

Ensure the following conditions are satisfied:

- Payment is in the nature of commission or brokerage.

- Payment is made to a resident.

- Aggregate payment exceeds the prescribed threshold during the financial year.

- Deductor is liable to deduct TDS (including individuals/HUFs subject to tax audit).

Step 2: Calculate TDS

Applicable Rate

- 5% (up to 31 March 2025)

- 2% (proposed from 1 April 2025)

Calculation Formula

TDS = Commission Amount × Applicable Rate

Example:

If commission paid = ₹1,00,000

TDS @ 5% = ₹5,000

Net amount payable = ₹95,000

## If PAN is not provided, higher TDS may apply under Section 206AA.

Step 3: Deduct TDS at the Correct Time

TDS must be deducted at the earlier of:

- Credit of commission to the payee’s account, or

- Actual payment

Step 4: Deposit TDS

## Due Date

- On or before 7th of the following month

- For March deductions: 30th April

## Payment Process

- Visit the official website of the Income Tax Department

- Select e-Pay Tax

- Choose TDS – Challan ITNS 281

- Enter TAN, Assessment Year, and payment details

- Complete payment through net banking

- Download the challan receipt for records

Step 5: File TDS Return

- File quarterly TDS return in Form 26Q

- Ensure correct PAN details of the deductee.

Step 6: Issue TDS Certificate

- Download Form 16A

- Issue it to the deductee within the prescribed time limit

Non-Compliance under Section 194H

Non-compliance with Section 194H of the Income-tax Act, 1961 can result in significant financial and legal consequences for the deductor. If TDS on commission or brokerage is not deducted, interest at 1% per month or part thereof is payable from the date it was deductible until the date of actual deduction. In cases where TDS is deducted but not deposited, interest at 1.5% per month or part thereof is charged from the date of deduction to the date of payment.

Additionally, failure to file the quarterly TDS return (Form 26Q) within the prescribed time attracts a late filing fee of ₹200 per day under Section 234E, subject to a maximum of the TDS amount. The Assessing Officer may also levy a penalty ranging from ₹10,000 to ₹1,00,000 under Section 271H for failure to file or for furnishing incorrect details. Further, the commission expense may be disallowed under Section 40(a)(ia), thereby increasing the taxable income of the business. In severe cases of willful default, prosecution provisions may also be invoked by the Income Tax Department. Proper and timely compliance is therefore essential to avoid unnecessary financial burden and regulatory scrutiny.

FAQs – Section 194H: TDS on Commission or Brokerage

1. What is Section 194H?

Section 194H provides for deduction of TDS on commission or brokerage paid to a resident.

2. What is the current TDS rate under Section 194H?

- 2% (effective from 1 October 2024)

- Earlier rate was 5%

If PAN is not furnished, TDS may be deducted at a higher rate under Section 206AA.

3. What is the threshold limit for deduction of TDS?

- ₹15,000 (up to 31 March 2025)

- ₹20,000 (effective from 1 April 2025)

TDS is applicable only if total commission or brokerage paid during the financial year exceeds this limit.

4. Who is required to deduct TDS under Section 194H?

Any person (including companies, firms, LLPs, etc.) paying commission or brokerage to a resident must deduct TDS.

Individuals or HUFs are required to deduct TDS only if they were liable for tax audit under Section 44AB in the preceding financial year.

5. When should TDS be deducted?

TDS must be deducted at the earlier of:

- Credit of commission to the payee’s account, or

- Actual payment

6. What payments are covered under commission or brokerage?

It includes payments received or receivable, directly or indirectly, for services in the course of buying or selling goods or in relation to any transaction.

7. Is TDS applicable on trade discounts?

No. Trade discounts given on a principal-to-principal basis are generally not treated as commission and therefore may not attract TDS under Section 194H.

8. Does Section 194H apply to payments made to non-residents?

No. Payments to non-residents are covered under Section 195 of the Income-tax Act, 1961, not Section 194H.

9. What forms are required for compliance?

- TDS payment through Challan ITNS 281

- Quarterly return in Form 26Q

- TDS certificate in Form 16A

All filings are made through the portal of the Income Tax Department.

10. What are the consequences of non-compliance?

Non-deduction or late deposit may result in:

- Interest (1% / 1.5% per month)

- Late filing fee under Section 234E

- Penalty under Section 271H

- Disallowance of expense under Section 40(a)(ia)

Leave a Reply