The presumptive taxation scheme provides a simplified method for computing taxable income for eligible taxpayers engaged in business activities by allowing income to be declared at a prescribed percentage of turnover or gross receipts.

Section 44AD applies to eligible resident taxpayers carrying on business. Under this section, where the total business turnover does not exceed ₹2 crore, taxable income may be declared at 8% of the turnover. However, where cash receipts do not exceed 5% of the total turnover, the enhanced threshold of ₹3 crore becomes applicable, and income may be declared at a reduced rate of 6% of the turnover.

This scheme aims to reduce compliance burden while ensuring ease of taxation for small businesses.

What is Section 44AD?

Section 44AD is a provision under the Income Tax Act of India that allows presumptive taxation for small businesses. It is designed to simplify tax compliance for eligible taxpayers by letting them declare income at a fixed rate instead of maintaining detailed books of accounts.

Applicability of Section 44AD

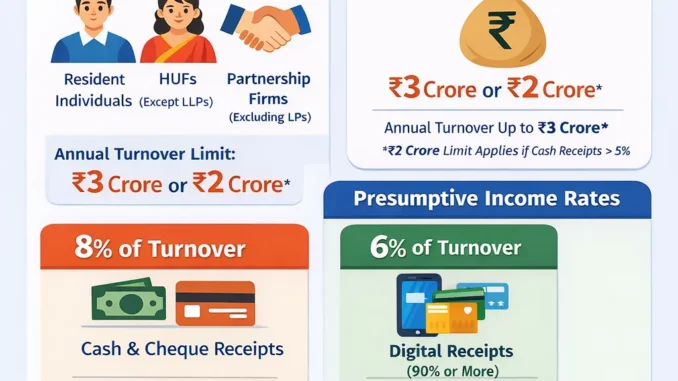

Section 44AD of the Income Tax Act is applicable to:

- Partnership Firms (excluding LLPs)—Firms (other than LLPs) running a business.

- Resident Individuals—Individuals residing in India carrying on a business.

- Hindu Undivided Families (HUFs)—Engaged in eligible business activities.

Eligibility

- Turnover/Receipts Limit: The business’s annual turnover or gross receipts should not exceed ₹2 crore in a financial year.

- Business Type: Any small business, like retail, trading, or manufacturing, but not professional services (those fall under Section 44ADA).

Presumptive Taxation Threshold Limits under Section 44AD

Section 44AD provides simplified taxation for small businesses by allowing income to be presumed at a fixed percentage of turnover or gross receipts. The threshold limits are as follows:

- Turnover/Gross Receipts Limit:

- The annual turnover or gross receipts of the business should not exceed ₹2 crore in a financial year.

- However, if a small business receives most of its payments digitally or via bank (≤5% in cash), it can opt for the higher turnover limit of ₹3 crore under Section 44AD.

- Presumptive Income Rate:

- 8% of total turnover/gross receipts if receipts are in cash or mixed mode.

- 6% of total turnover/gross receipts if 90% or more of the receipts are digital (bank transfers, UPI, cards, etc.).

- Digital Transactions Incentive:

- Businesses that receive most of their payments digitally benefit from a reduced presumptive income rate, encouraging cashless transactions.

# Section 44AD applies to small businesses with turnover ≤ ₹2 crore and presumes income at 8% or 6%, depending on the mode of receipts, simplifying compliance and reducing accounting requirements.

Advantages of Section 44AD

Section 44AD offers a simplified and efficient taxation framework for small businesses. It allows eligible taxpayers to declare income at a prescribed percentage of turnover, eliminating the need for detailed books of accounts and extensive record-keeping. This reduces the compliance burden and saves both time and cost associated with maintaining full accounting records. Additionally, the scheme provides an incentive for digital transactions, where businesses receiving 90% or more of payments digitally benefit from a lower presumptive income rate. Filing taxes under Section 44AD is straightforward through ITR-4, making it particularly suitable for small business owners and professionals seeking ease of compliance while remaining fully tax-compliant.

Conditions

- If you opt for Section 44AD, you cannot claim further business expenses separately.

- Once opted in, the business must continue under this scheme for 5 years; otherwise, special conditions apply.

- You cannot opt for loss deduction under this scheme except in the case of depreciation.

Key Points

| Feature | Details |

|---|---|

| Applicability | Resident individuals, HUF, partnership firms (not LLP) |

| Turnover Limit | ₹2 crore per F.Y./₹3 crore per F.Y |

| Presumptive Income | 8% (or 6% if digital receipts ≥90%) |

| Filing Form | ITR-4 |

| Accounting Requirement | No detailed books required |

| Business Types | Small businesses (trading, retail, manufacturing) |

FAQ – Section 44AD (Presumptive Taxation for Small Businesses)

1. What is Section 44AD?

Section 44AD is a provision under the Income Tax Act that allows small businesses to pay tax on a presumptive basis, i.e., income is calculated at a fixed percentage of turnover, without maintaining detailed books of accounts.

2. Who can opt for Section 44AD?

- Resident individuals,

- Hindu Undivided Families (HUFs),

- Partnership firms (excluding LLPs).

Eligible businesses exclude professions referred to under Section 44AA, like doctors, lawyers, and accountants.

3. What is the turnover limit for Section 44AD?

- Up to ₹3 crore if cash receipts do not exceed 5% of total turnover.

- Up to ₹2 crore if cash receipts exceed 5% of total turnover.

4. How is presumptive income calculated?

- 8% of turnover if receipts are in cash or mixed mode.

- 6% of turnover if 90% or more of receipts are digital (bank transfer, UPI, card, etc.).

5. What are the benefits of opting for Section 44AD?

- No need to maintain detailed books of accounts.

- Simplified ITR filing using ITR-4.

- Saves time and compliance costs.

- Encourages digital payments by offering a reduced presumptive rate.

6. Can I claim business expenses under Section 44AD?

No, the presumptive income already accounts for expenses. Only depreciation is allowed as an additional deduction.

7. Is Section 44AD mandatory?

No, it is optional for eligible businesses. However, once opted in, the business must continue under this scheme for 5 consecutive years unless turnover exceeds the limit.

8. Can digital receipts affect eligibility?

Yes, businesses receiving 90% or more payments digitally benefit from the lower 6% presumptive income rate and may be eligible for the higher ₹3 crore turnover limit if cash receipts are ≤5%.

9. How do I file taxes under Section 44AD?

Eligible taxpayers file Income Tax Return (ITR-4) for presumptive taxation. No detailed books are required, making compliance simpler and faster.

10. What happens if turnover exceeds the limit?

If turnover exceeds ₹3 crore (or ₹2 crore in high cash cases), the business cannot opt for Section 44AD and must maintain regular books of accounts under Section 44AA and file taxes under normal provisions.

Leave a Reply