The real estate landscape is in a constant state of flux, influenced by a myriad of factors. Among these, mortgage rate trends stand out as a key determinant of housing market dynamics. When coupled with the intricate interplay of demographics, the legal implications become particularly noteworthy.

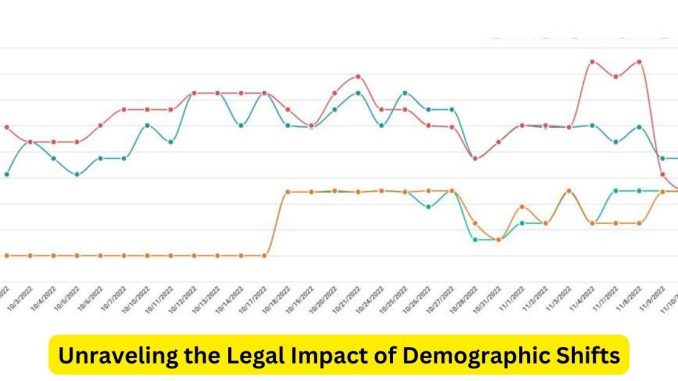

Understanding mortgage rate trends requires a closer look at the broader economic landscape. Central banks and financial institutions play a pivotal role in setting interest rates, directly impacting mortgage rates. In recent years, global economic uncertainties and fluctuations have contributed to a rollercoaster ride for these rates.

Demographics, the study of populations and their characteristics, also wield significant influence. As the demographics of a society evolve, so do the dynamics of its housing market. In many developed countries, an aging population has become a prominent trend. This demographic shift has legal implications, especially concerning property and estate planning laws.

Low mortgage rates often stimulate homebuying activity. Younger demographics, particularly first-time homebuyers, tend to benefit from these favorable rates, making homeownership more accessible. Governments may enact policies to encourage this demographic to enter the housing market, creating legal frameworks that support affordable housing initiatives and mortgage accessibility.

Conversely, an aging population may result in a surge of property transactions related to inheritance and estate planning. Legal systems may need to adapt to accommodate the complexities of transferring property assets among generations. Succession laws, tax regulations, and probate processes may require adjustments to align with the evolving needs of an older demographic.

Moreover, legal considerations extend to the financial institutions that facilitate mortgage transactions. Regulatory bodies often intervene to ensure fair lending practices and consumer protection. Demographic changes can prompt legal reviews of lending practices to address potential discriminatory impacts or to ensure that financial institutions are adequately serving diverse demographic groups.

In the context of mortgage rate trends and demographics, environmental and social sustainability considerations have gained prominence. Legal frameworks may evolve to incentivize environmentally conscious home purchases or to address housing disparities among different demographic groups.

In conclusion, the intricate dance between mortgage rate trends and demographics weaves a tapestry of legal considerations that ripple through the real estate landscape. Governments, regulatory bodies, and legal systems must remain vigilant, adapting to the evolving needs of diverse demographics while ensuring the stability and fairness of the housing market. As we navigate this complex terrain, the legal framework becomes not only a reflection of societal values but also a crucial instrument in shaping the future of real estate in an ever-changing world.

Leave a Reply