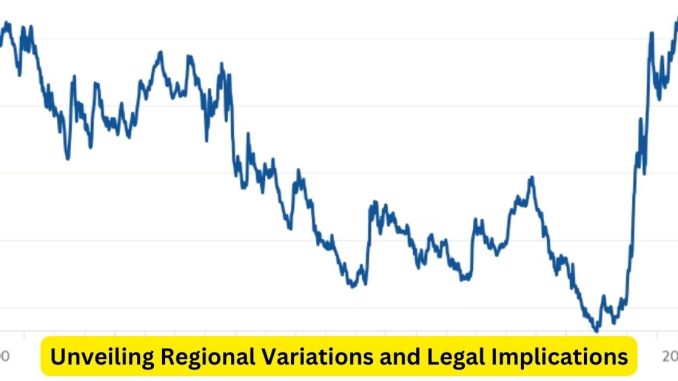

As individuals embark on the journey of homeownership, mortgage rates stand as a critical factor influencing their financial landscape. Understanding the nuances of mortgage rate benchmarking becomes even more crucial when considering the regional variations that can significantly impact the legal aspects of real estate transactions.

Mortgage rates, often tied to benchmark interest rates set by central banks, vary across regions due to a myriad of economic factors. These regional variations carry legal implications that can shape the dynamics of the local housing market. One key consideration is the regulatory environment that governs lending practices.

Different regions may have distinct legal frameworks overseeing mortgage lending. Regulatory bodies set guidelines to ensure fair lending practices, consumer protection, and market stability. Regional variations in these legal frameworks can influence the accessibility of mortgages, affecting the ease with which individuals can secure home financing.

Moreover, regional economic conditions play a pivotal role in shaping mortgage rates. Attorneys specializing in real estate law must stay attuned to these variations to provide accurate legal advice to clients. Economic downturns in a specific region may prompt legal interventions to prevent foreclosures, ensure fair lending, and stabilize the local housing market.

Property laws and regulations also exhibit regional disparities, impacting the legal landscape of mortgage transactions. Attorneys must navigate these differences, addressing nuances in property rights, zoning laws, and land use regulations. This ensures that real estate transactions adhere to the specific legal requirements of each region, safeguarding the interests of both buyers and sellers.

In some regions, government initiatives may influence mortgage rates through subsidies or incentive programs. Legal professionals need to stay informed about such initiatives to guide clients in leveraging available opportunities. These programs may be designed to promote affordable housing, sustainable development, or other social and economic objectives, adding layers of complexity to the legal considerations in real estate transactions.

Environmental considerations, another critical aspect of modern real estate, can also vary regionally. Attorneys may need to navigate legal frameworks related to eco-friendly building practices, energy efficiency standards, or other environmental regulations that impact the real estate landscape. Compliance with these regulations is essential for both lenders and borrowers involved in mortgage transactions.

In conclusion, mortgage rate benchmarking is a multifaceted process that demands a nuanced understanding of regional variations and their legal implications. Attorneys specializing in real estate law play a vital role in guiding clients through the intricate legal landscape of mortgage transactions, ensuring compliance with regional regulations, and addressing the diverse challenges posed by economic, regulatory, and environmental disparities across different locales.

Leave a Reply