In times of financial hardship or unexpected challenges, homeowners might find it difficult to meet their mortgage obligations. Mortgage modifications and loan workouts serve as potential remedies to assist borrowers in managing their mortgage payments, avoiding foreclosure, and retaining homeownership.

Understanding Mortgage Modifications

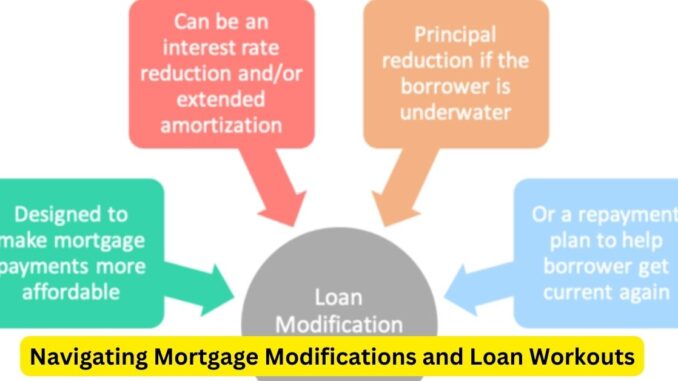

Mortgage modifications involve changes to the terms of the existing loan to make payments more manageable for borrowers facing financial difficulties. These modifications can include:

- Interest Rate Reductions: Lowering the interest rate to reduce monthly payments.

- Extension of Loan Terms: Extending the loan term to spread out payments over a longer period, reducing the monthly burden.

- Principal Forbearance or Forgiveness: Temporarily suspending or reducing the principal amount owed or forgiving a portion of the debt.

Loan Workouts: An Alternative Solution

Loan workouts are agreements between borrowers and lenders aimed at resolving delinquent loans or imminent default situations. Unlike mortgage modifications, which alter the terms of the existing loan, loan workouts are often short-term solutions to address immediate financial challenges. They can involve:

- Repayment Plans: Structuring a repayment schedule to catch up on missed payments while maintaining the original loan terms.

- Forbearance Agreements: Temporarily suspending or reducing payments for a specific period, allowing borrowers time to recover financially.

- Short Sale or Deed in Lieu of Foreclosure: Negotiating with the lender to sell the property for less than the outstanding mortgage balance or transferring ownership to the lender to avoid foreclosure.

Navigating the Process

Borrowers seeking mortgage modifications or loan workouts should take specific steps:

- Contacting the Lender: Initiate communication with the lender as soon as financial difficulties arise. Explaining the situation and providing documentation of hardship is crucial.

- Submitting a Request: Lenders typically require a formal request for a modification or workout. Completing the necessary paperwork accurately and promptly is essential.

- Seeking Professional Assistance: Consider consulting housing counselors, attorneys, or financial advisors specializing in mortgage assistance programs. These professionals can provide guidance and negotiate with lenders on behalf of borrowers.

Considerations and Implications

While mortgage modifications and loan workouts offer potential relief, there are considerations to be mindful of:

- Impact on Credit Score: These options may impact credit scores and should be considered in light of long-term financial goals.

- Lender Approval: Lenders assess the borrower’s financial situation and may not approve all modification or workout requests.

- Future Financial Commitments: Understand the implications of the modified terms or workout agreements, ensuring future affordability of payments.

Conclusion

Mortgage modifications and loan workouts can provide vital lifelines for homeowners facing financial challenges. Early communication with lenders, thorough documentation of hardship, and seeking professional assistance can significantly improve the chances of reaching a favorable resolution. By exploring these options proactively, borrowers can strive to overcome financial difficulties and maintain homeownership while navigating challenging times.

Leave a Reply