Winning a lottery can be exciting and life-changing, but it also comes with important tax implications. In India, lottery winnings are taxed at a special rate under the Income Tax Act, irrespective of your regular income slab. Before celebrating the prize money, it is essential to understand how much tax will be deducted, what provisions apply, and how to report such income in your Income Tax Return (ITR).

Meaning of Lottery Tax in India

Lottery tax in India refers to the tax charged on prize money won from lotteries, game shows, crossword puzzles, online gaming, and similar winnings. Under the Income Tax Act, such income is treated separately from normal salary or business income and is taxed at a special flat rate.

Below are the key provisions related to tax on lottery winnings in India:

Lottery Winnings Are Fully Taxable

Lottery prize money—whether from state lotteries, private draws, game shows, online gaming payouts, or raffle schemes—is treated as “Income from Other Sources” and is taxable in India. There’s no basic exemption limit or standard income-tax slab benefit applied to it.It applies to:

- Crossword puzzles

- State lotteries

- Online lotteries

- Game shows

- Prize money

Flat Tax Rate Under Income Tax Law

Under Section 115BB of the Income Tax Act, lottery winnings are taxed at a flat rate of 30% on the entire amount of the winnings.

Additional Cess and Surcharge

On top of the 30% basic tax:

✔ Health and Education Cess (4%)

➡ Applied on the amount of tax—not on the lottery winning itself—bringing the effective rate to about 31.2%.

✔ Surcharge (if applicable)

➡ If your total income, including the lottery win, exceeds certain limits (e.g., ₹50 lakh/₹1 crore), a surcharge (10%, 15%, 25%, etc.) applies on the tax amount, increasing the total tax burden.

TDS (Tax Deducted at Source) at Source

If the lottery prize exceeds ₹10,000, the organizer must deduct 30% TDS before paying you.

This means you usually receive the net amount after tax deduction.

You’ll get a Form-16A showing how much tax has been deducted—useful for filing your Income Tax Return (ITR).

No Deductions or Loss Set-Off Allowed

Income from lottery winnings cannot be reduced by claiming expenses (like ticket cost), nor can you set off losses from other sources or claim deductions under Section 80C/80D, etc.

Foreign Lottery Winnings

If an Indian resident wins a lottery abroad, that income is also taxable in India—but you may claim relief under a Double Taxation Avoidance Agreement (DTAA) if tax was paid in the foreign country (subject to proper documentation and Form-67 filing).

Reporting in ITR

Even after TDS is deducted at source, you must report your gross lottery winnings in your ITR under “Income from Other Sources” and reconcile the TDS amount claimed through your Form-16A

Penalty and Compliance Issues—Lottery Winnings in India

Winning a lottery comes with strict tax compliance requirements. Failure to properly report or pay tax on lottery income can result in penalties, interest, and legal consequences under the Income Tax Act.

1. Non-Reporting of Lottery Income

If a taxpayer fails to disclose lottery winnings in the Income Tax Return (ITR):

- It may be treated as under-reporting or misreporting of income

- Penalty can be:

- 50% of tax payable (for under-reporting)

- 200% of tax payable (for misreporting)

2. Interest on Non-Payment of Tax

If additional tax is payable (for example, due to surcharge or mismatch in TDS), interest may apply:

- Section 234A – Delay in filing return

- Section 234B – Default in payment of advance tax

- Section 234C – Deferment of advance tax

Interest is generally charged at 1% per month.

3. Failure to Pay Advance Tax

Although TDS is deducted at 30%, if total tax liability increases due to surcharge or other income, advance tax may be applicable. Failure may attract interest under Section 234B & 234C.

4. Incorrect TDS Reporting

- Ensure TDS deducted by organizer reflects in Form 26AS / AIS

- Claim correct TDS in ITR

- Keep Form 16A safely

Mismatch may lead to notices from the Income Tax Department.

5. Prosecution in Serious Cases

In cases of deliberate concealment or tax evasion, prosecution proceedings may be initiated under the Income Tax Act.

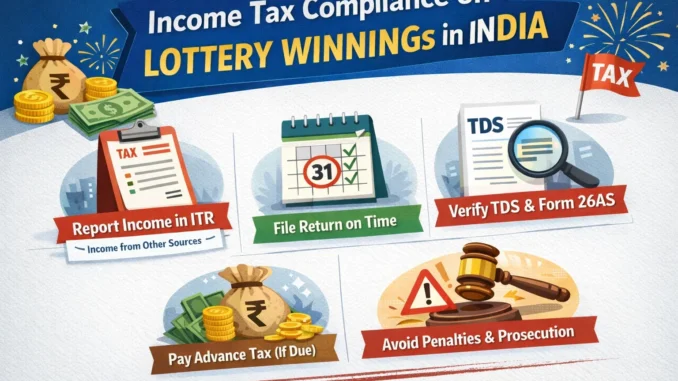

Compliance Checklist for Lottery Winners

- Report gross winnings under Income from Other Sources

- Verify TDS in Form 26AS

- File ITR on time

- Pay additional tax (if any)

- Maintain documents (Form 16A, prize certificate)

## Even if TDS is deducted, compliance is not complete until the income is properly disclosed in your ITR.

Frequently Asked Questions (FAQs) – Tax on Lottery Winnings in India

1. Is lottery income taxable in India?

Yes, lottery winnings are fully taxable under the Income Tax Act. They are taxed under the head “Income from Other Sources.”

2. What is the tax rate on lottery winnings?

Lottery winnings are taxed at a flat rate of 30% under Section 115BB, irrespective of your income slab. Additionally, a 4% Health & Education Cess is applicable.

3. Is TDS deducted on lottery winnings?

Yes. Under Section 194B, if the winnings exceed ₹10,000, the organizer must deduct TDS at 30% before making payment.

4. Can I claim deductions under Section 80C or 80D against lottery income?

No. No deductions under Chapter VI-A (such as 80C, 80D, etc.) are allowed against lottery winnings.

5. Can I claim the cost of the lottery ticket as an expense?

No. The cost of the lottery ticket cannot be deducted from the winnings.

6. Can lottery losses be set off against other income?

No. Losses from lottery or similar activities cannot be set off against any other income.

7. Do I need to report lottery winnings in my ITR if TDS is already deducted?

Yes. Even if TDS has been deducted, you must report the gross amount of winnings in your income tax return under “Income from Other Sources.”

8. Is a surcharge applicable on lottery winnings?

Yes. If your total income (including lottery winnings) exceeds specified limits (₹50 lakh, ₹1 crore, etc.), a surcharge will apply as per income tax provisions.

9. Are foreign lottery winnings taxable in India?

If you are a resident of India, global income (including foreign lottery winnings) is taxable in India. Relief may be available under DTAA, subject to conditions.

10. Does the basic exemption limit apply to lottery income?

No. Lottery income is taxed at a special rate and does not benefit from the basic exemption limit.

Leave a Reply