The new tax regime continues to be the default option, but for FY 2025–26, the government has provided significant relief by easing the tax slab rates under this regime. These changes are aimed at reducing the overall tax burden and increasing take-home income.

Income up to ₹12 lakh can effectively be tax-free, thanks to the increase in tax rebate to ₹60,000. This means many taxpayers will not have to pay any income tax if their total income falls within this limit.

At the same time, no changes have been made to the tax slabs under the old tax regime. Taxpayers opting for the old regime will continue to be taxed as per the existing slab structure, along with applicable deductions and exemptions.

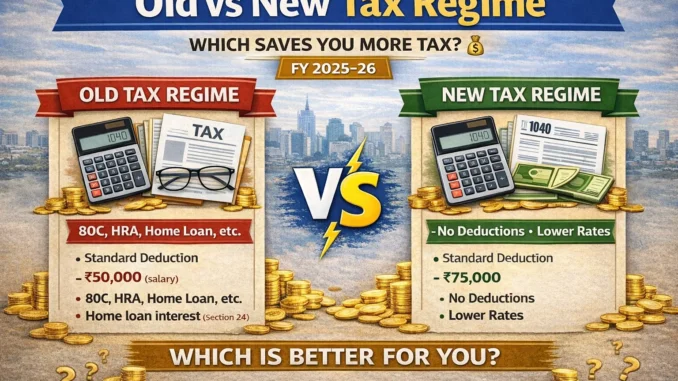

Income Tax Regime Comparison (Old vs New)—FY 2025–26

| Particulars | Old Tax Regime | New Tax Regime (Default) |

|---|---|---|

| Default Regime | No | Yes |

| Basic Exemption Limit | ₹2.5 lakh/₹3 lakh/₹5 lakh | ₹4 lakh |

| Tax Slab Rates | Higher slab rates | Lower & relaxed slab rates |

| Deductions (80C, 80D, etc.) | Allowed | Not allowed |

| HRA, LTA, Standard Exemption | Allowed | Mostly not allowed* |

| Standard Deduction (Salary) | ₹50,000 | ₹75,000 |

| Rebate under Section 87A | Up to ₹12,500 (income up to ₹5 lakh) | Up to ₹60,000 (income up to ₹12 lakh) |

| Tax-free Income (Practical) | Up to ₹5 lakh | Up to ₹12 lakh |

| Suitable for | Taxpayers with high deductions & investments | Taxpayers with fewer deductions |

| Compliance & Planning | More documentation required | Simple & hassle-free |

* Some limited exemptions, like the employer’s NPS contribution, are still allowed under the new regime.

Old Tax Regime – Income Tax Rates for FY 2025–26 (AY 2026–27)

The Old Tax Regime continues to be a popular choice for taxpayers who claim deductions and exemptions under various provisions of the Income-tax Act. It allows taxpayers to reduce their taxable income through eligible investments and expenses.

Income Tax Slabs and Rates

For individuals below 60 years of age/HUF, the income tax rates under the Old Tax Regime for FY 2025–26 are as follows:

| Income Slab (₹) | Tax Rate |

|---|---|

| Upto 2,50,000 | Nil |

| 2,50,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

For individuals aged 60 years and above but below 80 years, the Old Tax Regime offers a higher basic exemption limit compared to regular taxpayers. This provides additional tax relief for senior citizens.

| Income Slab (₹) | Tax Rate |

|---|---|

| Upto 3,00,000 | Nil |

| 3,00,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

For individuals aged above 80 years, also known as super senior citizens, the Old Tax Regime provides an even higher basic exemption limit than both regular taxpayers and senior citizens (60–80 years). This ensures additional tax relief for the elderly population.

| Income Slab (₹) | Tax Rate |

|---|---|

| Upto 5,00,000 | Nil |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

Key Points

- Basic Exemption Limit: ₹5,00,000 (higher than ₹2.5 lakh for regular taxpayers and ₹3 lakh for senior citizens 60–80 years)

- Rebate under Section 87A: ₹12,500 for income up to ₹5 lakh → effectively tax-free for this income.

- Deductions Allowed:

- Section 80C: Investments like PPF, ELSS, Life Insurance Premium (up to ₹1.5 lakh)

- Section 80D: Health Insurance Premium

- HRA & LTA: House Rent Allowance and Leave Travel Allowance

- Standard Deduction: ₹50,000 for salaried individuals

New Tax Regime—Income Tax Slabs (Default Scheme) FY 2025–26

The New Tax Regime offers lower tax rates and a higher rebate but fewer deductions compared to the Old Tax Regime. It is the default option for taxpayers who do not specifically opt for the old regime.

Income Tax Slabs & Rates

| Income Slab (₹) | Tax Rate |

|---|---|

| Upto 4,00,000 | Nil |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001- 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Key Updates in the New Tax Regime (FY 2025–26)

- Rebate under Section 87A

- The rebate increased to ₹60,000, making income up to ₹12 lakh practically tax-free.

- Note: This rebate does not apply to special incomes like capital gains.

- Standard Deduction

- You can claim ₹75,000 as a standard deduction from your salary income.

- Surcharge

- The maximum surcharge is 25% on very high incomes (above ₹2 crore).

- In comparison, the old regime allows upto 30% surcharge

- Senior Citizen Benefits

- Under the new regime, there are no special slab rates for senior citizens.

- Everyone follows the same tax slabs, regardless of age.

New Tax Regime vs Old Tax Regime: A Comparative Analysis (FY 2025–26)

Quick Rule to Decide

| Situation | Better Option |

|---|---|

| Heavy tax-saving investments | Old Regime |

| Few or no deductions | New Regime |

| Income up to ₹12 lakh | New Regime (zero tax) |

| Want simplicity | New Regime |

| Home loan + HRA | Old Regime |

# There is no universal “best” regime.

The better regime depends on your income and deductions, not just tax rates.

How to Opt for New or Old Tax Regime (FY 2025–26)

- Default Rule (Very Important)

If you do nothing, your return will be processed under the New Tax Regime. The new tax regime is the DEFAULT regime.

2. For SALARIED EMPLOYEES

# While Filing ITR

You can choose every year while filing your income tax return:

- Select Old Regime → if you want deductions (80C, HRA, etc.)

- Select New Regime → if you want lower slabs & simplicity

* No separate form required for salaried individuals.

# For TDS by Employer

- Inform your employer at the start of the year

- This affects monthly TDS only

- Final choice can still be changed while filing ITR

3. For BUSINESS/PROFESSIONAL INCOME

# Mandatory Form: Form 10-IEA

If you want to opt OUT of the New Regime and choose the Old Regime, you must:

✔ File Form 10-IEA

✔ Before filing your ITR

4. How to Choose on Income Tax Portal

- Login to incometax.gov.in

- Go to e-File → Income Tax Returns → File ITR

- Select assessment year

- Choose Tax Regime

- New Regime (default)

- Old Regime (if eligible)

- Submit & verify ITR

## Quick Decision Guide

| Category | Can it change every year? | Form needed |

|---|---|---|

| Salaried / Other income | Yes | No |

| Business/Profession | No (restricted) | Form 10-IEA |

Surcharge Rates (Applicable to BOTH Old & New Tax Regime(s))

Surcharge is charged on income tax, not on total income.

| Total Income | Surcharge Rate |

|---|---|

| Up to ₹50 lakh | Nil |

| ₹50 lakh – ₹1 crore | 10% |

| ₹1 crore – ₹2 crore | 15% |

| ₹2 crore – ₹5 crore | 25% |

| Above ₹5 crore | 25% (New Regime) / 37% (Old Regime)* |

*Important Difference

- New Tax Regime → Surcharge capped at 25%

- Old Tax Regime → Surcharge can go up to 37%

Marginal Relief (Applicable to BOTH Schemes)

What is Marginal Relief?

Marginal Relief ensures that extra tax payable due to surcharge does not exceed the income exceeding the surcharge threshold.

In simple words: You will never pay more tax than the extra income earned just because of the surcharge.

Example of Marginal Relief

Case:

- Total Income = ₹50,10,000

- Threshold = ₹50,00,000

- Extra Income = ₹10,000

If tax + surcharge exceeds ₹10,000, marginal relief will reduce tax to that limit.

This rule applies equally to Old & New Regime

Health & Education Cess

- 4% cess is applicable on:

- Income Tax + Surcharge

- Same for both regimes

Quick Comparison Summary

| Particulars | Old Regime | New Regime |

|---|---|---|

| Max Surcharge | 37% | 25% (capped) |

| Marginal Relief | Yes | Yes |

| Cess | 4% | 4% |

FAQ: Income Tax Comparison Old vs New Tax Regime (FY 2025–26)

Q1. What is the Old Tax Regime?

Answer:

The Old Tax Regime allows taxpayers to claim multiple deductions and exemptions such as 80C, 80D, HRA, LTA, home loan interest, etc., but applies higher tax slab rates.

Q2. What is the New Tax Regime?

Answer:

The New Tax Regime offers lower tax slab rates with wider income slabs, but most deductions and exemptions are not allowed. It is the default tax regime from FY 2023–24 onwards.

Q3. Which tax regime is default for FY 2025–26?

Answer:

The New Tax Regime is the default regime. If a taxpayer does not choose any option while filing the return, tax will be calculated under the New Regime.

Q4. Can I choose between Old and New Regime every year?

Answer:

- Salaried / Non-business taxpayers: Yes, every year

- Business or professional income: Restricted (choice can be exercised once via Form 10-IEA)

Q5. What are the basic tax slabs under both regimes?

Answer:

- Old Regime: Fewer slabs with higher rates

- New Regime: Slabs with ₹4 lakh income gap and lower rates up to higher income levels

Q6. What is the standard deduction under both regimes?

Answer:

- Old Regime: ₹50,000 (salary income)

- New Regime: ₹75,000 (salary income)

Q7. Are deductions like 80C and HRA allowed in the New Regime?

Answer:

No. Most deductions and exemptions such as 80C, 80D, HRA, LTA, and home loan interest (self-occupied) are not allowed under the New Regime.

Q8. Is rebate under Section 87A available in both regimes?

Answer:

Yes.

- Under the New Regime, tax is nil up to ₹12 lakh due to rebate.

- Under the Old Regime, rebate applies only up to ₹5 lakh.

Q9. How does surcharge differ between the two regimes?

Answer:

- New Regime: Surcharge capped at 25%

- Old Regime: Surcharge can go up to 37%

This makes the New Regime more beneficial for very high-income taxpayers.

Q10. Is marginal relief available in both regimes?

Answer:

Yes. Marginal relief applies under both regimes, ensuring that extra tax due to surcharge does not exceed the additional income earned.

Q11. Is Health & Education Cess applicable in both regimes?

Answer:

Yes. 4% Health & Education Cess is applicable on Income Tax + Surcharge under both regimes.

Q12. Which regime is better for salaried employees?

Answer:

- Old Regime: Better if you claim high deductions and exemptions

- New Regime: Better if you have minimal investments and want simple compliance

Q13. Which regime is better for high-income taxpayers?

Answer:

For income above ₹5 crore, the New Tax Regime is usually more tax-efficient due to the 25% surcharge cap.

Q14. Can I change my tax regime while filing ITR even if my employer deducted TDS under another regime?

Answer:

Yes. The final choice can be changed at the time of filing the Income Tax Return, irrespective of TDS deducted by the employer.

Q15. How should I decide the best tax regime?

Answer:

Always calculate tax under both regimes considering:

- Income level

- Deductions & exemptions

- Surcharge impact

Then choose the option with lower total tax liability.

Leave a Reply