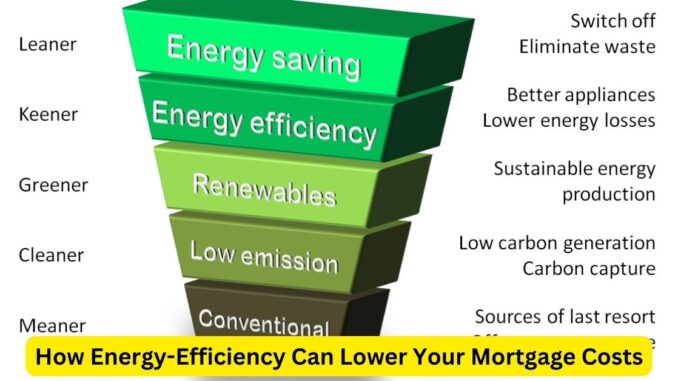

In today’s environmentally conscious world, homeowners are not only interested in reducing their carbon footprint but also in saving money. One effective way to achieve both goals is by investing in energy-efficient features for your home. Beyond contributing to a greener planet, energy-efficient upgrades can significantly impact your monthly expenses, including your mortgage costs. Here’s how energy efficiency can lead to substantial savings on your mortgage.

**1. Lower Utility Bills:

One of the most direct ways energy efficiency impacts your finances is by reducing your utility bills. By investing in energy-efficient appliances, LED lighting, proper insulation, and energy-efficient windows, you can significantly cut down on your electricity and heating expenses. These savings can be substantial over time, providing you with more disposable income that can be directed towards your mortgage payments.

**2. Energy-Efficient Mortgage (EEM) Programs:

Many financial institutions offer Energy-Efficient Mortgage (EEM) programs, allowing homebuyers to finance energy-efficient improvements into their mortgage. This means you can include the cost of upgrades such as solar panels, high-efficiency HVAC systems, or energy-efficient insulation in your mortgage loan. The savings from reduced energy costs can then be used to offset the higher mortgage payment, making it a financially viable and eco-friendly choice.

**3. Tax Incentives and Rebates:

Numerous governments provide tax incentives and rebates to encourage energy-efficient home improvements. By taking advantage of these programs, you can reduce the out-of-pocket costs for upgrades. These savings can be redirected towards your mortgage payments, helping you pay off your loan faster and potentially saving thousands of dollars in interest over the life of your mortgage.

**4. Increased Property Value:

Energy-efficient homes are in high demand among homebuyers. When you invest in energy-efficient upgrades, you not only save money on your utility bills but also increase the resale value of your home. A home with green features is attractive to potential buyers, allowing you to sell your property at a higher price. The increased property value can translate into more equity, helping you pay off your mortgage more quickly or secure a better refinancing deal in the future.

**5. Improved Mortgage Terms:

Lenders increasingly recognize the value of energy-efficient homes. Some financial institutions offer better mortgage terms, such as lower interest rates or reduced closing costs, for energy-efficient properties. By demonstrating the energy efficiency of your home, you may qualify for these improved terms, leading to significant long-term savings on your mortgage.

In conclusion, investing in energy-efficient features not only benefits the environment but also offers tangible financial advantages, including substantial savings on your mortgage costs. From lower utility bills and Energy-Efficient Mortgage programs to tax incentives, increased property value, and improved mortgage terms, the benefits of energy efficiency are multifaceted. By making eco-friendly choices for your home, you can enjoy a more comfortable living environment, lower monthly expenses, and a reduced overall financial burden, creating a win-win situation for both your wallet and the planet.

Leave a Reply