Navigating Closing Costs: Anticipating Expenses in Homebuying

Closing costs encompass various fees and expenses incurred at the final stage of a real estate transaction. Understanding these costs is crucial for prospective homebuyers […]

Closing costs encompass various fees and expenses incurred at the final stage of a real estate transaction. Understanding these costs is crucial for prospective homebuyers […]

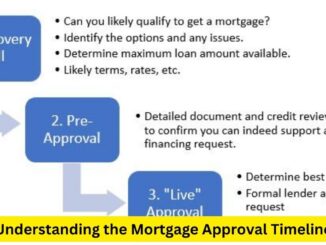

The mortgage approval process involves several steps, each contributing to a comprehensive timeline that aspiring homeowners should understand before embarking on their homeownership journey: Pre-Approval […]

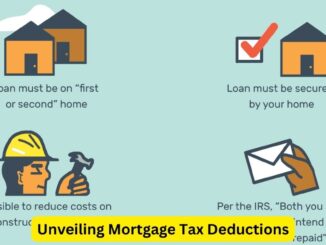

Understanding mortgage tax deductions can significantly impact homeowners’ finances, offering opportunities to save on taxes. Here’s a comprehensive guide to maximizing these benefits: Mortgage Interest […]

Investing in real estate can diversify your portfolio and generate passive income, but securing a mortgage for an investment property differs from obtaining a loan […]

Selecting the right down payment is a critical step in the home-buying process. It shapes your upfront costs, monthly payments, and overall financial health. Here’s […]

For homeowners looking to leverage the equity built in their property, second mortgages and Home Equity Lines of Credit (HELOCs) offer viable options. These financial […]

Buying your first home is an exhilarating milestone, yet navigating the world of mortgages can seem daunting. Understanding the key aspects of mortgages is crucial […]

When securing a mortgage, one critical decision borrowers face is whether to opt for a rate lock. A rate lock is an agreement between the […]

Mortgage insurance serves as a protective measure for lenders, safeguarding them against borrower default in cases where the down payment is less than 20% of […]

The culmination of the homebuying journey is the mortgage closing, a pivotal stage where all the necessary documents are signed, and ownership of the property […]

Copyright © 2025 | WordPress Theme by MH Themes