The intricate dance between legal frameworks and macroeconomic indicators shapes the landscape of mortgage rate benchmarking, influencing the real estate industry and financial markets alike. This article delves into the interplay between legal considerations and macroeconomic indicators, shedding light on how these factors collectively impact mortgage rate benchmarking.

At the heart of mortgage rate benchmarking lies a web of legal considerations that seek to ensure transparency, fairness, and consumer protection. As traditional benchmarks like the London Interbank Offered Rate (LIBOR) phase out, legal experts are crucial in guiding the transition to alternative benchmarks and ensuring compliance with evolving regulations. The legal landscape must adapt to the changing financial environment, balancing the interests of lenders, borrowers, and regulators.

Transparency in mortgage rate disclosures is a cornerstone of legal frameworks governing real estate transactions. Laws such as the Truth in Lending Act (TILA) mandate lenders to provide borrowers with clear and accurate information about the terms of their mortgage, including the benchmark used for interest rate adjustments. Legal experts play a pivotal role in upholding these disclosure requirements, ensuring that borrowers are well-informed about the potential impacts of benchmark changes on their mortgage payments.

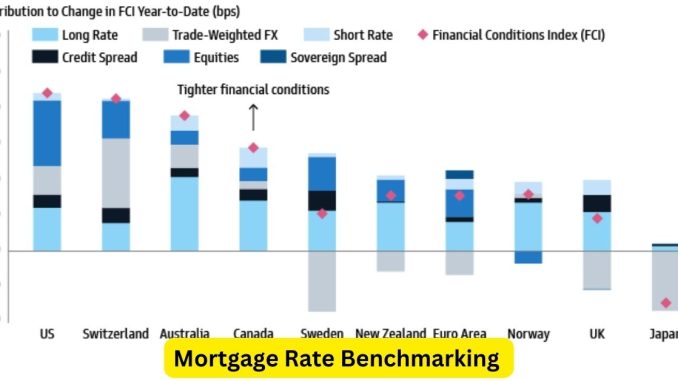

Macroeconomic indicators, on the other hand, serve as a compass guiding the decisions of central banks and financial institutions. Interest rates, unemployment figures, and inflation rates are key macroeconomic indicators that influence monetary policies, subsequently affecting mortgage rates. Legal professionals must stay abreast of these indicators to provide informed counsel to financial institutions and real estate stakeholders navigating the dynamic landscape of mortgage rate benchmarking.

The transition away from LIBOR exemplifies the intricate relationship between legal considerations and macroeconomic indicators. As central banks respond to economic conditions by adjusting interest rates, legal experts guide the industry through the complexities of adopting new benchmarks. This transition not only requires compliance with legal standards but also a keen understanding of how macroeconomic indicators shape the financial environment.

In times of economic uncertainty, legal considerations extend to issues such as foreclosure prevention and eviction moratoriums. Macroeconomic indicators, reflecting the overall health of the economy, may influence government interventions to stabilize housing markets. Legal professionals must navigate the ethical dimensions of these interventions, balancing the rights of homeowners and lenders while considering broader economic goals.

The rise of digital transformation in the financial sector adds another layer to the relationship between legal frameworks and macroeconomic indicators. As technology evolves, legal experts are tasked with ensuring that digital mortgage processes comply with existing regulations while adapting to the changing economic landscape.

In conclusion, the future of mortgage rate benchmarking is intricately woven into the fabric of legal considerations and macroeconomic indicators. Legal experts play a crucial role in guiding the industry through transitions, upholding transparency, and ensuring compliance. As macroeconomic indicators continue to influence interest rates and economic policies, the synergy between legal expertise and economic insights becomes increasingly vital for a resilient and adaptive mortgage market.

Leave a Reply