Section 115BBC of the Income-tax Act governs the taxability of anonymous donations received by charitable trusts and institutions.

Charitable organizations often receive donations where the identity of the donor (name, address, and other prescribed particulars) is not recorded. Such contributions are treated as anonymous donations under the Act.

Acceptance of anonymous donations can lead to adverse tax consequences, as income covered under Section 115BBC is subject to tax at a special rate, notwithstanding the general exemption available to charitable trusts under Sections 11 and 12. Therefore, charitable institutions are required to maintain proper donor records to mitigate the risk of additional tax liability and ensure compliance with the statutory provisions.

Meaning of Anonymous Donation under Section 115BBC

The term “anonymous donation” is specifically defined under Section 115BBC of the Income-tax Act, 1961.

An anonymous donation means any voluntary contribution referred to in sub-clause (iia) of clause (24) of Section 2, where the person or institution receiving such contribution does not maintain a record of the identity of the donor, including name, address, and such other prescribed particulars.

Accordingly, if a charitable trust or institution fails to maintain adequate details establishing the identity of the donor, the contribution so received is treated as an anonymous donation for the purposes of taxation under Section 115BBC.

Section 115BBC of the Income-tax Act, 1961—Taxation of Anonymous Donations

To curb the channelization of unaccounted money into charitable organizations through anonymous donations, the legislature introduced Section 115BBC in the Income-tax Act, 1961.

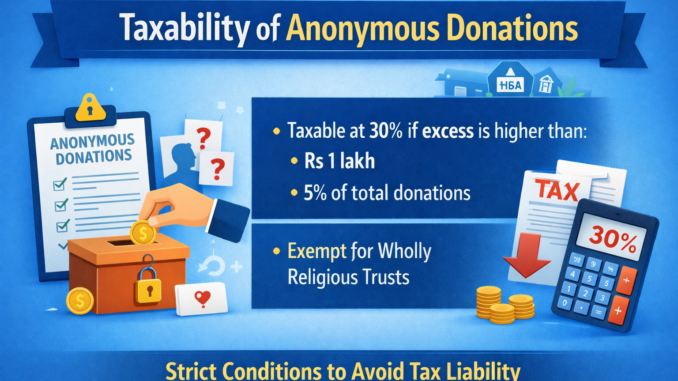

As per this provision, income received by a charitable trust or institution in the form of anonymous donations is included in its total income and taxed at a special rate of 30%, notwithstanding the general exemptions available under Sections 11 and 12.

Taxability of Anonymous Donations

In accordance with subsection (1) of Section 115BBC, anonymous donations are taxable at the rate of 30% to the extent they exceed the higher of the following limits:

- ₹1,00,000 or

- 5% of the total donations received by the trust or institution during the previous year

Only the excess amount over the above threshold is subject to tax.

Taxability in Case of Wholly Religious Institutions

Anonymous donations received by a wholly religious trust or institution are fully exempt from tax. Accordingly, Section 115BBC does not apply to such entities.

Taxability in Case of Partly Religious and Partly Charitable Institutions

In the case of trusts or institutions having both religious and charitable objects:

- Anonymous donations specifically directed towards any educational institution, university, hospital, or medical institution run by such trust shall be taxable, but only to the extent such donations exceed 5% of total donations or ₹1,00,000 whichever is higher.

- Anonymous donations received for other purposes shall remain exempt from taxation.

Taxability in Case of Wholly Charitable Institutions

For wholly charitable trusts or institutions, anonymous donations are taxable only to the extent they exceed 5% of total donations or ₹1,00,000, whichever is higher.

Note: No deduction or exemption is available in respect of such taxable anonymous donations even if the entire amount is applied towards charitable purposes.

Non-Applicability of Section 115BBC

Section 115BBC shall not apply in the following cases:

- Anonymous donations received by a wholly religious trust or institution.

- Anonymous donations received by a partly religious and partly charitable trust, except where such donations are made specifically for any educational or medical institution run by it.

- Anonymous donations received by:

- Any university or educational institution covered under Section 10(23C)(iiiab) and wholly or substantially financed by the Government.

- Any hospital or medical institution covered under Section 10(23C)(iiiac) and wholly or substantially financed by the Government.

Compliance Requirement

Charitable and religious institutions are required to maintain proper records of donors, including name, address, and prescribed particulars, at the time of receiving donations. In cases where anonymous donations are received, institutions must closely monitor the statutory limits prescribed under the Income-tax Act to ensure compliance and avoid additional tax liability.

Tax Exemption for Charitable Trusts

Charitable trusts and institutions in India are eligible for tax exemption under the Income-tax Act, 1961, subject to compliance with prescribed statutory conditions. The primary provisions governing such exemptions are Sections 11, 12, 12AB, and 80G of the Act.

Income Exempt under Sections 11 and 12

Income derived from property held under trust wholly for charitable or religious purposes is exempt from tax, provided:

- At least 85% of the income is applied towards charitable or religious purposes in India during the relevant previous year; and

- The trust or institution is registered under Section 12AB.

The remaining 15% of income may be accumulated without any specific conditions.

Voluntary Contributions

Voluntary contributions received by a registered charitable trust (other than corpus donations) are treated as income but qualify for exemption if applied in accordance with Section 11.

Corpus donations, received with a specific direction, are fully exempt under Section 11(1)(d), subject to prescribed conditions.

Impact of Section 115BBC

Notwithstanding the general exemption provisions, anonymous donations taxable under Section 115BBC do not qualify for exemption, even if such donations are applied towards charitable objects. Such income is taxed at a special rate of 30%.

Registration and Compliance

To claim exemption, a charitable trust must:

- Obtain and maintain valid registration under Section 12AB;

- Maintain proper books of account and donor records;

- File the return of income within the prescribed time limit; and

- Ensure compliance with audit requirements, where applicable.

Other Relevant Provisions

- Donations received by trusts approved under Section 80G enable donors to claim deductions, subject to conditions.

- Trusts engaged in business activities must ensure such activities are incidental to their charitable objects and that separate books of account are maintained.

Conclusion

Tax exemption for charitable trusts is available only when statutory conditions are strictly complied with. Failure to maintain proper records, non-application of income, or receipt of taxable anonymous donations may result in withdrawal or restriction of exemption under the Income-tax Act.

FAQs on Charitable Trust Exemptions under the Income-tax Act

1. What tax exemptions are available to charitable trusts in India?

Charitable trusts registered under Section 12AB are eligible for tax exemption on income under Sections 11 and 12, subject to fulfillment of prescribed conditions such as application of income and timely filing of returns.

2. Is registration under Section 12AB mandatory to claim exemption?

Yes, Registration under Section 12AB is mandatory. Without such registration, a trust cannot claim exemption under Sections 11 and 12.

3. How much income must be applied to claim exemption?

A minimum of 85% of the income derived during the previous year must be applied towards charitable or religious purposes in India. The remaining 15% may be accumulated without conditions.

4. Are voluntary donations treated as income?

Yes, Voluntary contributions (excluding corpus donations) are treated as income under Section 2(24)(iia) and are eligible for exemption if applied in accordance with Section 11.

5. Are corpus donations fully exempt?

Yes, Donations received with a specific direction to form part of the corpus are exempt under Section 11(1)(d), subject to compliance with prescribed conditions.

6. Are anonymous donations exempt from tax?

No, Anonymous donations are taxable under Section 115BBC at a special rate of 30%, to the extent they exceed the prescribed threshold, even if such donations are applied for charitable purposes.

7. Is income from business activities exempt?

Income from business activities is exempt only if:

- The business is incidental to the attainment of charitable objects, and

- Separate books of account are maintained.

8. Can a charitable trust accumulate income for future use?

Yes, A trust may accumulate income:

- Up to 15% without conditions, or

- Beyond 15% by complying with Section 11(2), including filing Form 10 and specifying the purpose and period of accumulation.

9. Is audit mandatory for charitable trusts?

Yes, If the total income (before exemption) exceeds the basic exemption limit, the trust must get its accounts audited by a Chartered Accountant and file the audit report in Form 10B or 10BB, as applicable.

10. Is filing of return mandatory even if income is exempt?

Yes. Charitable trusts claiming exemption must file their income tax return within the due date prescribed under Section 139(1).

11. Can exemption be cancelled by the Income-tax Department?

Yes. Registration under Section 12AB may be cancelled if the trust’s activities are found to be not genuine or not in accordance with its stated charitable objects.

12. What is the role of Section 80G for charitable trusts?

Approval under Section 80G allows donors to claim deduction for donations made to the trust, subject to specified limits and conditions.

13. Are religious trusts also eligible for exemption?

Yes, Income of religious trusts is also eligible for exemption under Sections 11 and 12, subject to compliance with applicable provisions.

14. What happens if 85% income is not applied during the year?

If 85% of income is not applied and no valid accumulation option is exercised, the unapplied income becomes taxable.

15. What records must a charitable trust maintain?

A charitable trust must maintain:

- Proper books of account

- Donor details (name, address, PAN, etc.)

- Utilisation records of funds

- Audit reports and statutory filings

Leave a Reply