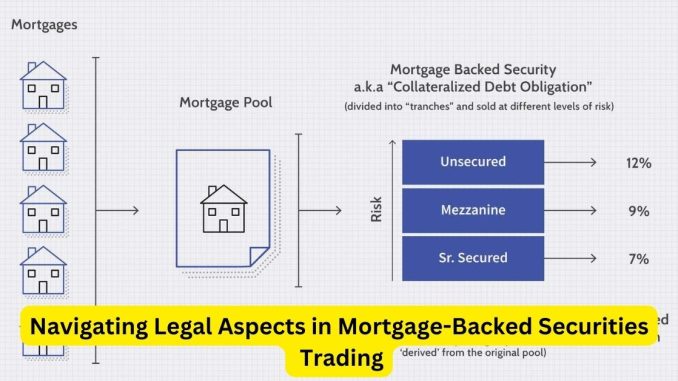

The world of finance is often underpinned by complex instruments like mortgage-backed securities (MBS). These financial products pool together mortgages, creating tradable assets. However, within this realm of opportunities, there exist critical legal considerations that both investors and traders must navigate.

Firstly, regulatory compliance stands as a cornerstone in MBS trading. The Securities and Exchange Commission (SEC) regulates these securities, imposing stringent guidelines to protect investors. Compliance mandates demand transparency in disclosures, ensuring that all relevant information about the underlying mortgages is provided to potential buyers. Any omission or misrepresentation in these disclosures could result in severe legal repercussions.

Another crucial aspect involves the contractual intricacies within MBS. The legal agreements governing these securities can be highly complex, outlining payment structures, prepayment terms, and collateral details. Lawyers specializing in financial law play an integral role in drafting and interpreting these contracts to safeguard the interests of all parties involved.

Moreover, the risk of litigation looms large in MBS trading. Disputes may arise over issues such as breach of contract, misrepresentation, or negligence in due diligence. For instance, if the quality of the underlying mortgages differs significantly from what was represented, investors may pursue legal action against the issuer or seller of the MBS.

Fraudulent practices have also been a concern in this domain. Cases of misrepresenting loan characteristics or manipulating data to inflate the value of MBS have led to significant legal penalties. Legal frameworks, therefore, aim to prevent such malpractices, often imposing strict penalties on those found engaging in fraudulent activities.

The legal landscape surrounding MBS trading is continually evolving. Court rulings, regulatory updates, and changes in market practices influence legal considerations. Hence, staying abreast of these developments is crucial for market participants to ensure compliance and mitigate legal risks.

Additionally, the global nature of MBS trading introduces jurisdictional complexities. Transactions involving parties from different countries might fall under diverse legal systems, adding layers of complexity and requiring a comprehensive understanding of international laws.

In conclusion, navigating the legal aspects of mortgage-backed securities trading necessitates a comprehensive understanding of regulatory compliance, intricate contractual agreements, risk mitigation strategies, and vigilance against fraudulent activities. Engaging legal expertise, conducting thorough due diligence, and keeping abreast of legal developments are imperative for stakeholders to operate within the bounds of the law while participating in this dynamic financial market.

Leave a Reply