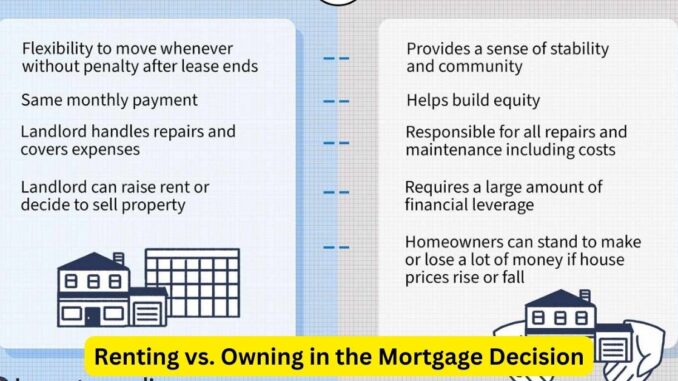

The decision between renting and owning a home involves a multitude of financial and lifestyle considerations, each carrying its own set of pros and cons. Evaluating these factors can guide individuals toward making an informed choice that aligns with their current situation and future goals.

Renting:

Renting offers flexibility and lower initial financial commitment compared to homeownership. It’s an attractive option for individuals seeking mobility, minimal maintenance responsibilities, and predictable monthly expenses. Some key aspects to consider:

- Flexibility: Renting provides the freedom to relocate more easily without the burden of selling a property. This is beneficial for individuals in transient job positions or uncertain about their long-term location.

- Limited Financial Responsibility: Renters are generally not responsible for major repairs or maintenance costs, which are typically the landlord’s responsibility. This can provide financial relief compared to the unexpected costs of homeownership.

- Predictable Expenses: Renters usually have a clear idea of their monthly housing expenses, as rent amounts remain relatively stable throughout the lease term, without the unpredictability of property taxes or maintenance costs.

However, renting does have its downsides. Rent payments do not contribute to building equity, and rent prices might increase over time. Moreover, renters have limited control over property modifications or improvements.

Owning:

Homeownership offers a sense of stability, potential appreciation in property value, and the opportunity to build equity over time. Key aspects to consider include:

- Equity Building: Homeowners accumulate equity as they pay down their mortgage, providing a long-term financial asset that can potentially grow over time.

- Property Control: Homeownership grants the freedom to modify or improve the property to suit personal preferences without seeking landlord approval.

- Stability and Long-Term Investment: For many, homeownership represents stability and a long-term investment in a property that could appreciate in value over time.

However, homeownership entails higher upfront costs, including a down payment, closing costs, property taxes, insurance, and ongoing maintenance expenses. It also requires a longer-term commitment to the property and location.

Making the decision between renting and owning depends on various factors, including financial readiness, lifestyle preferences, and future plans. Factors such as market conditions, job stability, and personal goals play significant roles in this decision-making process.

Consulting with financial advisors or real estate professionals can provide valuable insights into individual circumstances, helping individuals weigh the pros and cons of each option and make a well-informed decision aligned with their current situation and long-term aspirations.

Leave a Reply