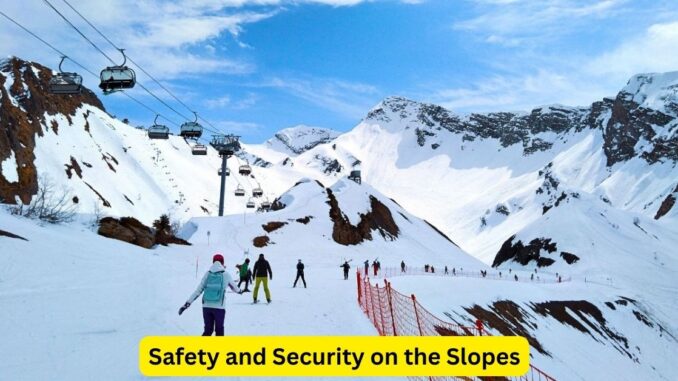

Ski resorts are winter wonderlands, attracting thousands of enthusiasts every year with promises of fresh powder, breathtaking slopes, and thrilling adventures. However, behind the scenes, ski resort owners and operators face numerous challenges, including unpredictable weather, on-site accidents, and property damage. In the face of these risks, having comprehensive insurance coverage is not just a choice; it’s a necessity to ensure the safety and security of both visitors and the business itself.

Understanding the Risks

Ski resorts face a unique set of risks that require specialized insurance coverage. Weather-related incidents like avalanches, heavy snowfall, or even sudden thaws can impact slopes and infrastructure. Accidents involving skiers or snowboarders, as well as injuries from chairlifts or other equipment, are constant concerns. Moreover, property damage from natural disasters or accidents can disrupt operations significantly.

Types of Insurance Coverage

- General Liability Insurance: This fundamental coverage protects ski resorts from claims arising due to accidents on their property, including injuries sustained while skiing, snowboarding, or participating in other activities. It covers medical expenses, legal fees, and potential settlements.

- Property Insurance: Property insurance covers the physical assets of the ski resort, including lodges, equipment, ski lifts, and snow grooming machines. It provides protection against damage from fires, storms, vandalism, or theft.

- Workers’ Compensation Insurance: Ski resorts employ a large number of staff, from instructors to maintenance personnel. Workers’ compensation insurance ensures that employees are covered in case of work-related injuries, covering medical costs and lost wages.

- Ski Equipment and Rental Liability Insurance: Ski resorts often rent out equipment to visitors. This insurance covers damage or theft of rental equipment and protects against liability claims related to the use of this equipment.

- Business Interruption Insurance: If a ski resort is forced to shut down due to a covered event, such as a natural disaster, business interruption insurance provides financial support by covering lost revenue and operating expenses during the closure.

Customizing Insurance for Ski Resorts

Each ski resort is unique, and its insurance needs depend on factors like location, size, and the range of activities offered. Working closely with an insurance provider experienced in the hospitality and outdoor recreation industry is essential. These specialists can tailor insurance policies to address the specific risks faced by the resort, ensuring comprehensive coverage.

Conclusion

Ski resorts provide unforgettable experiences for winter sports enthusiasts, but behind the scenes, ensuring the safety and security of visitors and staff is paramount. With the right insurance coverage in place, ski resorts can navigate the challenges posed by nature and human activities, allowing visitors to enjoy the slopes with peace of mind. By investing in appropriate insurance, ski resorts not only protect their financial interests but also uphold their commitment to providing a safe and enjoyable environment for all winter sports enthusiasts.

Leave a Reply