Taxation of Non-Resident Indians (NRIs) in India is governed by the Income Tax Act, 1961. The tax liability of an individual depends primarily on their residential status for the relevant financial year.

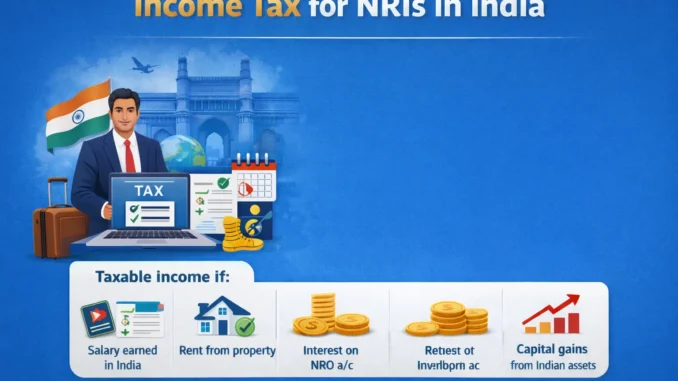

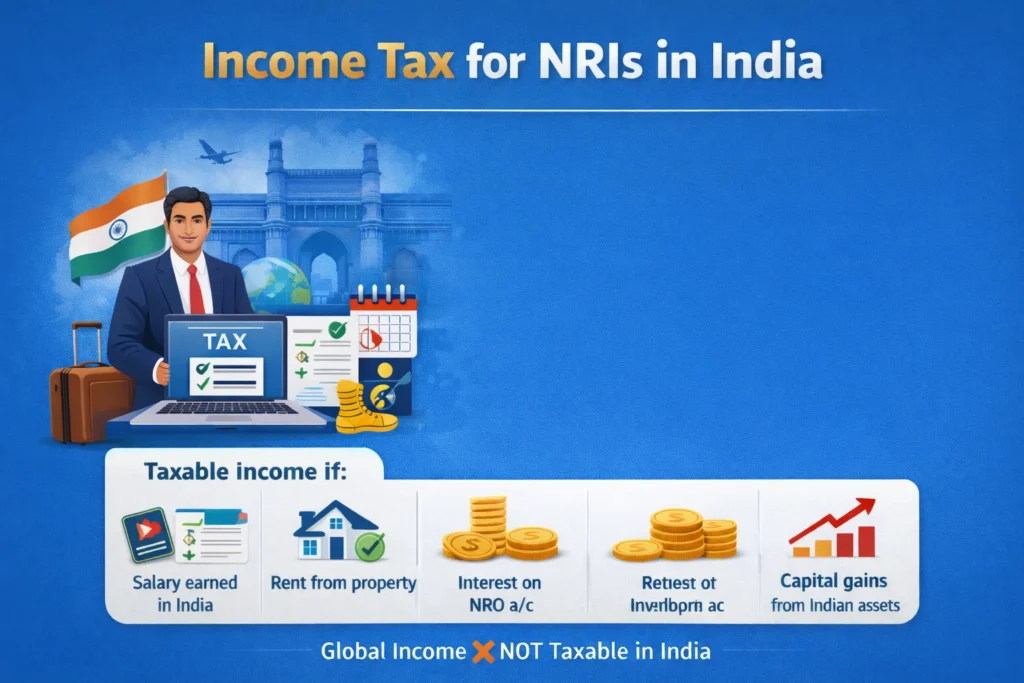

An NRI is liable to pay tax in India only on income that is earned or received in India. This typically includes:

- Salary received for services rendered in India

- Rental income from property situated in India

- Capital gains arising from transfer of assets located in India

- Interest earned on NRO (Non-Resident Ordinary) accounts

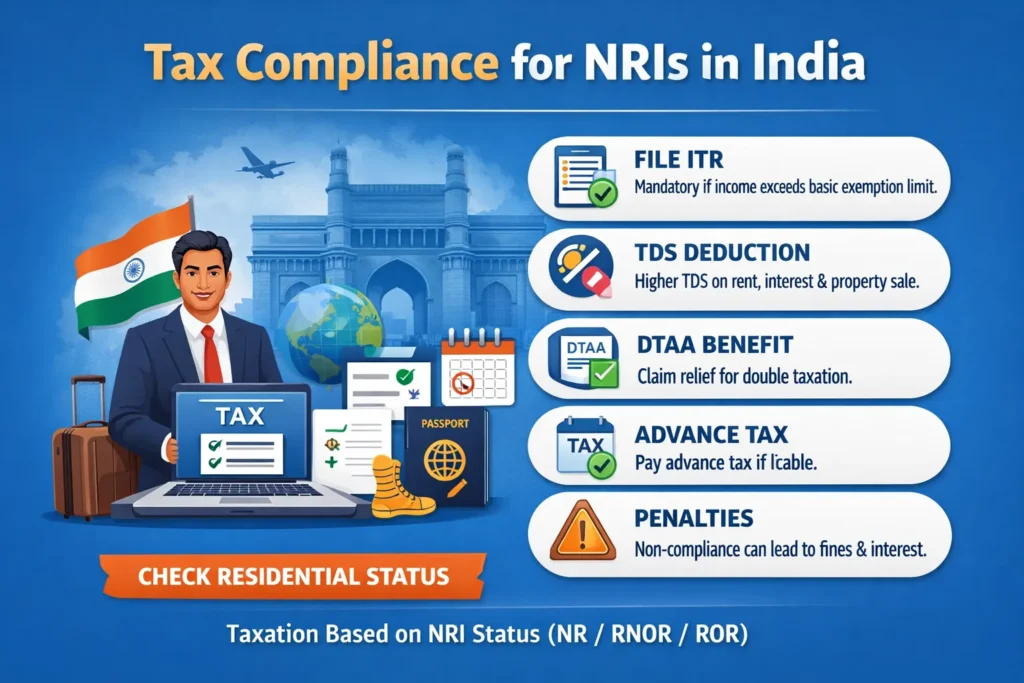

To ensure compliance, NRIs must:

- Adhere to TDS (Tax Deducted at Source) provisions

- File income tax returns within prescribed due dates (if applicable)

- Properly report Indian income and claim relief under DTAA, wherever eligible

Failure to comply may result in interest, penalties, or notices from the tax authorities.

Budget 2026—Key Relief for Returning NRIs

As per the Budget 2026 proposal, a special tax relief has been introduced for certain returning NRIs:

If an individual:

- Was a non-resident for a continuous period of five years, and

- Subsequently becomes a resident in India due to employment under a Central Government scheme,

Then:

- The individual will be eligible to claim exemption on income earned outside India.

- Provided he or she continues to remain a resident in India for a continuous period of five years after returning.

What This Means in Simple Terms

This provision is designed to encourage professionals working abroad to return to India under government schemes without facing immediate taxation on their foreign income.

In short, eligible returning NRIs can enjoy tax relief on their foreign income for up to five years after becoming a resident, subject to prescribed conditions.

What is NRI Income Tax in India?

Taxation of Non-Resident Indians (NRIs) in India is governed by the Income Tax Act, 1961. The taxability of income depends on the individual’s residential status for the relevant financial year.

For NRIs, only income that is earned or received in India is taxable in India. Foreign income is generally not taxable unless the individual qualifies as a resident.

Income Taxable in India for NRIs

The following types of income are typically taxable in India:

- Salary earned in India or for services rendered in India → Taxable

- Rental income from property located in India → Taxable

- Capital gains from sale of Indian shares, mutual funds, or immovable property → Taxable

- Interest income:

- Interest from NRO (Non-Resident Ordinary) accounts → Taxable

- Interest from NRE (Non-Resident External) accounts → Generally tax-free (subject to conditions)

- Interest from FCNR (Foreign Currency Non-Resident) accounts → Tax-free (subject to conditions)

NRIs must also comply with applicable TDS provisions, return filing requirements, and reporting norms.

How to Determine the Residential Status of an NRI?

Before determining tax liability, it is essential to establish your residential status under Indian tax law. This status decides whether only Indian income is taxable or global income becomes taxable in India.

Basic Conditions for Residential Status

An individual is considered a resident in India for a financial year if he or she satisfies any one of the following conditions:

- Stayed in India for 182 days or more during the relevant financial year, OR

- Stayed in India for 60 days or more during the relevant financial year and 365 days or more during the preceding four financial years.

(Note: In certain cases, such as Indian citizens leaving India for employment or visiting India, the 60-day condition may be substituted with 182 days, subject to specific provisions.)

If neither of the above conditions is satisfied, the individual is treated as a Non-Resident (NR) for that financial year.

Classification of Resident Individuals

If a person qualifies as a Resident, the law further categorizes residential status into two types:

1. Resident and Ordinarily Resident (ROR)

An individual is treated as a Resident and Ordinarily Resident (ROR) if:

- He/she has been resident in India in at least 2 out of the 10 preceding financial years, AND

- Has stayed in India for 730 days or more during the 7 preceding financial years.

# Tax implication:

Global income (Indian + foreign income) is taxable in India.

2. Resident but Not Ordinarily Resident (RNOR)

If a person qualifies as a resident but does not satisfy the additional conditions mentioned above, he/she is classified as a Resident but Not Ordinarily Resident (RNOR).

# Tax implication:

- Indian income → Taxable

- Foreign income → Taxable only if it is derived from a business controlled or profession set up in India

Why Residential Status Matters

Residential status is the foundation of NRI taxation in India. Even a small change in the number of days stayed in India can significantly impact tax liability, especially regarding foreign income.

NRI Residential Status – Comparison Table

| Particulars | Non-Resident (NR) | Resident but Not Ordinarily Resident (RNOR) | Resident and Ordinarily Resident (ROR) |

|---|---|---|---|

| Basic Stay Condition | Does NOT satisfy 182 days or 60+365 rule | Satisfies basic resident condition | Satisfies basic resident condition |

| Additional Conditions | Not Applicable | Does NOT satisfy additional conditions (2 out of 10 years + 730 days rule) | Satisfies additional conditions |

| Indian Income | Taxable | Taxable | Taxable |

| Foreign Income | Not Taxable | Taxable only if business/profession controlled from India | Fully Taxable |

| Global Income Taxed? | No | Partially | Yes |

| Ideal For | Individuals living abroad | Returning NRIs (initial years) | Long-term Indian residents |

Is Foreign Income of NRIs Taxable in India?

The taxability of foreign income for NRIs depends entirely on their residential status under the Income Tax Act, 1961.

Residential status is determined separately for each financial year, based on the number of days stayed in India.

1. If You Are a Resident

If you qualify as a Resident (particularly Resident and Ordinarily Resident – ROR):

- Your global income is taxable in India.

- This means income earned in India as well as income earned outside India must be reported and taxed in India (subject to relief under DTAA, if applicable).

2. If You Are a Non-Resident (NRI)

If your residential status is Non-Resident (NR):

- Only income earned or received in India is taxable.

- Income earned outside India is not taxable in India.

This is the most important benefit available to NRIs under Indian tax law.

Income Tax Slab Rates for NRIs (FY 2025-26 / AY 2026-27)

The income tax slab rates applicable to NRIs are governed by the Income Tax Act, 1961.

# Important:

NRIs are taxed at the same slab rates as resident individuals. However, certain benefits (like rebate under Section 87A in some cases) may not be available to NRIs.

NRIs can opt for either:

- Old Tax Regime

- New Tax Regime (Default regime, unless opted otherwise)

Old Tax Regime Slabs

| Total Income | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

* Health & Education Cess: 4%

* Surcharge: Applicable on higher income

New Tax Regime Slabs (Section 115BAC)

| Total Income | Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

* Health & Education Cess: 4%

* Surcharge: Applicable as per income

Important Notes for NRIs

1. No Basic Exemption Enhancement

Higher basic exemption limit available to senior citizens is not applicable to NRIs.

All NRIs are taxed under normal individual slabs, regardless of age.

2. Capital Gains Are Taxed Separately

Capital gains for NRIs are taxed at special rates:

- Short-Term Capital Gains (Section 111A) → 20%

- Long-Term Capital Gains (listed shares) → 12.5% (above threshold)

- Long-Term Capital Gains (property) → 12.5%

These rates are separate from slab rates.

3. Rebate under Section 87A

Rebate under Section 87A is generally not available to NRIs.

Quick Summary

✔ NRIs follow same slab rates as residents

✔ No senior citizen benefit

✔ Capital gains taxed separately

✔ TDS often deducted at higher rates

What Is Considered Income Earned in India?

The following types of income are treated as income earned in India and are therefore taxable for NRIs:

* Salary

- Salary received in India, or

- Salary for services rendered in India

→ Taxable in India

* Income from House Property

- Rent received from property located in India

→ Taxable in India

* Capital Gains

- Gains arising from sale of:

- Property situated in India

- Indian shares or mutual funds

→ Taxable in India

* Interest Income

- Interest from fixed deposits (FDs)

- Interest from savings bank accounts

- Interest from NRO accounts

→ Taxable in India

(Interest on NRE and FCNR accounts is generally exempt, subject to conditions.)

Important Clarification

Simply transferring foreign income to an Indian bank account does not make it taxable in India. What matters is:

- Where the income was earned, and

- Your residential status for that financial year.

Deductions and Exemptions for NRIs

Non-Resident Indians (NRIs) are eligible for several deductions and exemptions under the Income Tax Act, 1961. However, some benefits available to resident individuals may not be available to NRIs.

Let us understand what deductions and exemptions NRIs can claim in India.

1. Deductions Available Under Section 80C (Up to ₹1.5 Lakh)

NRIs can claim deduction under Section 80C for certain investments and payments made in India.

Eligible deductions include:

- Life insurance premium (policy must be in India)

- Children’s tuition fees (for education in India)

- Principal repayment of home loan for property in India

- ELSS (Equity Linked Savings Scheme) investments

- ULIPs (Unit Linked Insurance Plans)

Note: Investments like PPF and NSC are generally not available for fresh investment by NRIs (existing accounts may continue subject to rules).

2. Deduction on Home Loan Interest – Section 24(b)

NRIs can claim:

- Deduction up to ₹2,00,000 for interest paid on a housing loan for a self-occupied property in India.

- For let-out property, the actual interest paid is allowed (subject to loss set-off limits).

3. Deduction Under Section 80D – Medical Insurance

NRIs can claim deduction for:

- Medical insurance premium paid for self, spouse, children, or parents (if policy is taken in India).

4. Deduction Under Section 80E – Education Loan

Interest paid on an education loan taken for higher education (self, spouse, children) is eligible for deduction without any upper limit (subject to prescribed conditions).

5. Capital Gains Exemptions

NRIs can also claim exemptions on capital gains under certain sections:

Section 54

Exemption on long-term capital gains from sale of residential property if reinvested in another residential property in India.

Section 54EC

Exemption if capital gains are invested in specified bonds (such as NHAI or REC bonds) within prescribed time limits.

Section 54F

Exemption on sale of long-term capital asset (other than residential property) if proceeds are invested in residential property in India.

Deductions Not Available to NRIs

- Standard deduction against salary (if not earning salary in India)

- Some allowances and exemptions available only to residents

- Certain savings schemes meant exclusively for resident individuals

Important Points for NRIs

- TDS is often deducted at higher rates for NRIs (especially on capital gains and property sale).

- NRIs can claim refund by filing Income Tax Return (ITR) if excess TDS is deducted.

- DTAA (Double Taxation Avoidance Agreement) relief may be available if income is taxed in both countries.

Resident vs NRI – Deduction Comparison Chart

| Particulars | Resident Individual | NRI |

|---|---|---|

| Section 80C (LIC, ELSS, Home Loan Principal, Tuition Fees) | Available | Available |

| PPF (New Investment) | Available | Not allowed (new accounts) |

| NSC | Available | Not allowed |

| Section 80D (Medical Insurance) | Available | Available (if policy in India) |

| Home Loan Interest – Section 24(b) | Available | Available |

| Capital Gains Exemptions (54, 54EC, 54F) | Available | Available |

| Interest on NRE Account | Taxable | Exempt (subject to status) |

| Global Income Taxation | Taxable | Not taxable (if Non-Resident) |

Important Compliance Points

1. Lower or Nil TDS Certificate

If the actual tax liability is lower than TDS being deducted, the NRI can apply for a lower deduction certificate under Section 197.

2. DTAA Benefit

NRIs can claim benefit under Double Taxation Avoidance Agreement (DTAA), if applicable, by submitting required documents (Tax Residency Certificate, Form 10F, etc.).

3. Filing of ITR

If excess TDS is deducted, filing an Income Tax Return is necessary to claim refund.

FAQ – Tax Compliance for Non-Resident Indians (NRIs) in India

1. Is it mandatory for NRIs to file Income Tax Return (ITR) in India?

NRIs must file an ITR in India if:

- Their total taxable income in India exceeds the basic exemption limit.

- They have capital gains from sale of Indian assets.

- They wish to claim refund of excess TDS.

- They want to carry forward losses.

Even if TDS is deducted, filing may still be required to claim refund.

2. What income is taxable in India for NRIs?

Only income that is:

- Earned in India, OR

- Received in India

Examples include salary for services rendered in India, rental income, capital gains from Indian assets, and NRO interest.

Foreign income is generally not taxable if the individual qualifies as a Non-Resident.

3. What are the TDS provisions applicable to NRIs?

TDS is often deducted at higher rates for NRIs:

- Rent → 30% + surcharge + cess

- NRO interest → 30% + surcharge + cess

- Property sale → 10% / 20% depending on capital gains type

NRIs can apply for a lower TDS certificate if actual tax liability is lower.

4. Can NRIs claim DTAA benefit?

Yes. If income is taxed in both India and the country of residence, NRIs can claim relief under the Double Taxation Avoidance Agreement (DTAA), subject to submission of:

- Tax Residency Certificate (TRC)

- Form 10F

- Self-declaration

5. What happens if an NRI fails to comply with tax provisions?

Non-compliance may result in:

- Interest under Sections 234A, 234B, 234C

- Penalties

- Notices from Income Tax Department

- Difficulty in repatriation of funds

6. Do NRIs need to report foreign assets in India?

Only if they qualify as Resident and Ordinarily Resident (ROR).

Non-Residents are generally not required to report foreign assets in India.

7. Can NRIs carry forward capital losses?

Yes. Capital losses can be carried forward if the Income Tax Return is filed within the prescribed due date.

8. Is advance tax applicable to NRIs?

Yes. If total tax liability (after TDS) exceeds ₹10,000 in a financial year, advance tax provisions apply.

9. Which ITR form is applicable to NRIs?

- ITR-2 → Salary, house property, capital gains, interest income

- ITR-3 → Business or professional income

10. Can NRIs claim refund of excess TDS?

Yes. If excess TDS has been deducted, filing ITR is required to claim refund.

Leave a Reply