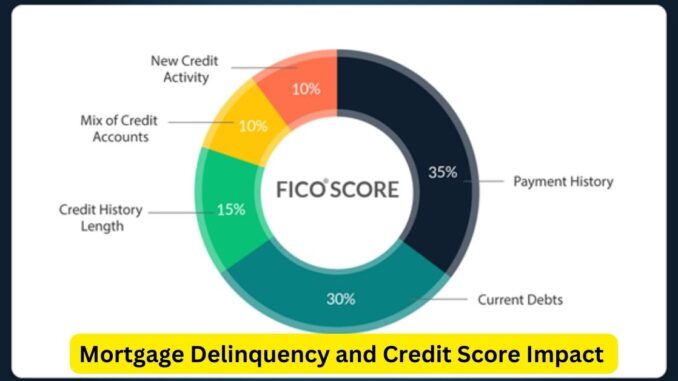

When it comes to financial stability, few things are as important as your credit score. Among the factors that can significantly impact your credit score, mortgage delinquency is one of the most critical. In this article, we will delve into the relationship between mortgage delinquency and credit scores, exploring the consequences and offering guidance on how to mitigate the impact.

Understanding Mortgage Delinquency:

Mortgage delinquency occurs when a homeowner fails to make their mortgage payments on time. A mortgage is typically considered delinquent if the payment is not received within 30 days of its due date. Delinquency can happen for various reasons, including job loss, financial hardship, or unexpected emergencies.

Impact on Credit Score:

Mortgage delinquency can have a significant negative impact on your credit score. Here’s how it works:

- Late Payments: Each missed mortgage payment is reported to credit bureaus, and it can result in a drop in your credit score. The more payments you miss, the more significant the impact.

- Credit Reporting: Mortgage delinquencies are reported to the major credit bureaus (Experian, Equifax, and TransUnion), and they can remain on your credit report for up to seven years, depending on the severity.

- Credit Score Reduction: A single missed mortgage payment can cause a noticeable decrease in your credit score, potentially by 60 to 100 points or more. The longer the delinquency continues, the more severe the impact on your credit score.

- Risk Assessment: Lenders and creditors use your credit score to assess your creditworthiness. A lower credit score due to mortgage delinquency can make it harder to obtain credit in the future, and if you are approved, you may face higher interest rates.

Mitigating the Impact:

While mortgage delinquency can have a significant negative effect on your credit score, there are steps you can take to mitigate the damage and work towards financial recovery:

- Communication with Lender: If you’re facing financial hardship, it’s essential to communicate with your mortgage lender as soon as possible. They may offer options such as forbearance or loan modification to help you get back on track.

- Timely Payments: As you work with your lender to address delinquency, make every effort to resume making on-time mortgage payments. Consistently paying on time will gradually improve your credit score.

- Credit Repair: Consider seeking professional credit repair assistance. Credit counseling agencies can provide guidance on managing debt and improving your creditworthiness.

- Budgeting and Financial Planning: Create a budget and financial plan to help you better manage your finances. This can include reducing expenses, increasing income, and prioritizing mortgage payments.

- Monitor Your Credit: Regularly monitor your credit report to ensure that any inaccuracies related to the delinquency are corrected. You can obtain free annual credit reports from each of the major credit bureaus.

In conclusion, mortgage delinquency can have a lasting impact on your credit score, making it challenging to secure credit and affecting your financial well-being. However, by taking proactive steps to address the delinquency, communicate with your lender, and prioritize timely payments, you can work toward rebuilding your credit and achieving financial stability once again. It’s important to remember that with time and responsible financial management, you can recover from mortgage delinquency and minimize its long-term consequences.

Leave a Reply