For many people, purchasing a home is one of the most significant financial transactions they will ever undertake. Securing a mortgage is often a necessary step in achieving homeownership, and understanding the intricacies of mortgage servicing is crucial for borrowers. Let’s delve into what borrowers should know about mortgage servicing.

What is Mortgage Servicing?

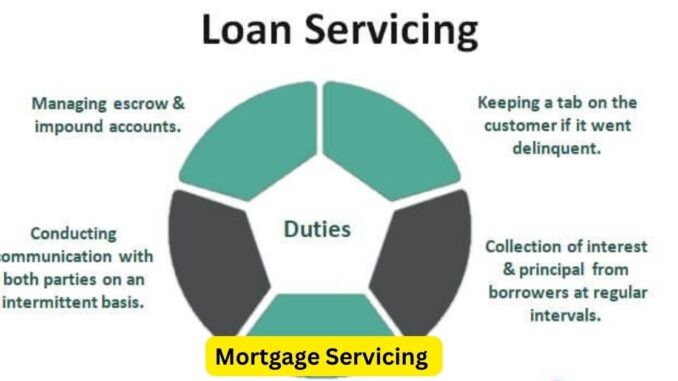

Mortgage servicing refers to the management of a mortgage loan after it has been originated by the lender. Essentially, it involves the day-to-day administration of your mortgage account, including collecting monthly payments, maintaining records, and ensuring compliance with various regulations.

Your Mortgage Servicer

In most cases, your mortgage servicer is not the same entity that provided you with the loan. Lenders frequently sell the rights to service loans to specialized companies. Borrowers should be aware that their mortgage servicer can change over time, and they may receive a notice about this. It’s crucial to stay informed and adjust your payment arrangements accordingly.

Monthly Payments

One of the primary responsibilities of a mortgage servicer is to collect your monthly payments. Borrowers should ensure they understand the breakdown of their monthly payment, which typically includes principal, interest, taxes, and insurance (often referred to as PITI). Being aware of these components can help you budget effectively.

Escrow Accounts

Many borrowers have an escrow account established by their servicer. This account collects funds for property taxes and homeowners’ insurance premiums, which are paid on your behalf when they come due. Keep an eye on your escrow account to ensure it has sufficient funds and that you are not overpaying or underpaying these expenses.

Customer Service

When dealing with a mortgage servicer, excellent customer service is crucial. Borrowers should have access to a responsive and helpful customer service department to address any questions or concerns they may have about their mortgage. Be sure to keep records of all communication with your servicer.

Loan Modifications and Assistance

In times of financial hardship, mortgage servicers can provide options for loan modifications or assistance programs. If you are facing difficulties making your mortgage payments, reach out to your servicer as early as possible to explore potential solutions and avoid foreclosure.

Mortgage Statements

Regularly review your mortgage statements to ensure that payments are correctly applied and that there are no discrepancies. Your statement should provide a breakdown of your payments, including how much goes toward principal and interest.

Prepayment Options

Some borrowers may want to pay off their mortgage early. Mortgage servicers should provide information about prepayment options and any potential penalties or restrictions associated with paying off the loan ahead of schedule.

Escalating Issues

If you encounter problems with your mortgage servicer that cannot be resolved through regular channels, you have the option to escalate the issue to relevant regulatory authorities. Borrowers should be aware of their rights and the protections afforded to them under mortgage servicing regulations.

In conclusion, understanding the role of a mortgage servicer and staying informed about your mortgage terms is essential for borrowers. Regularly review your mortgage statements, communicate effectively with your servicer, and seek assistance if you face financial challenges. By being proactive and knowledgeable, borrowers can navigate the mortgage servicing process with confidence and achieve their homeownership goals.

Leave a Reply