The landscape of mortgage loan underwriting is undergoing a transformative shift with the advent of automation technologies. As the industry embraces efficiency and speed through automated processes, attorneys play a crucial role in ensuring the legal integrity of these advancements. Here is a comprehensive guide for attorneys navigating mortgage loan underwriting automation.

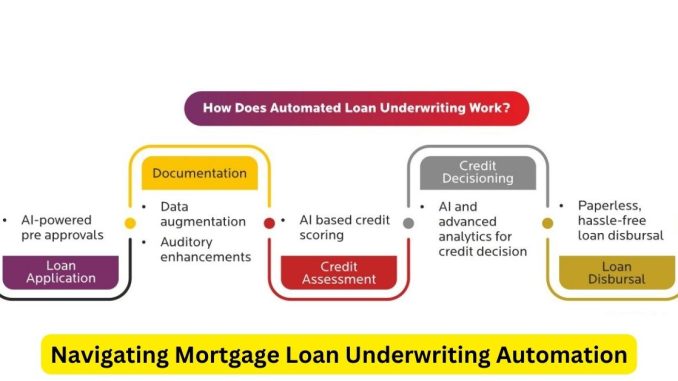

Understanding the Basics: Mortgage loan underwriting is the process of evaluating a borrower’s creditworthiness and the risk associated with lending. Automation in underwriting involves the use of technology, algorithms, and artificial intelligence to streamline and expedite this assessment.

Legal Compliance: Attorneys must first ensure that automated underwriting systems comply with all relevant laws and regulations. This includes adherence to fair lending laws, anti-discrimination statutes, and consumer protection regulations. Legal professionals play a vital role in scrutinizing algorithms to eliminate biases and ensure fair treatment of all borrowers.

Transparency in Decision-Making: Automated underwriting systems often rely on complex algorithms to make lending decisions. Attorneys advocate for transparency in these processes, ensuring that borrowers have a clear understanding of how their applications are evaluated. Legal professionals can push for clear disclosure requirements to uphold transparency standards.

Data Privacy and Security: The use of automation involves the processing of vast amounts of sensitive borrower data. Attorneys must ensure that automated underwriting systems comply with data privacy regulations, safeguarding the confidentiality and security of borrower information. Legal scrutiny is crucial in preventing unauthorized access and protecting against data breaches.

Fair Housing and Equal Credit Opportunity: Automated underwriting systems must be designed and implemented to avoid discriminatory outcomes. Attorneys play a critical role in ensuring that algorithms do not inadvertently perpetuate biases based on race, gender, or other protected characteristics. They advocate for fair housing and equal credit opportunity, upholding the principles of non-discrimination in lending.

Legal Review of Technology Contracts: Attorneys engage in a thorough review of contracts with technology vendors providing automated underwriting solutions. They ensure that the terms and conditions align with legal standards, protecting the interests of both lenders and borrowers. Legal professionals negotiate agreements that clearly define responsibilities, liabilities, and dispute resolution mechanisms.

Monitoring and Compliance Reporting: Attorneys contribute to the development of systems that monitor and assess the ongoing compliance of automated underwriting processes. Regular compliance reporting ensures that lenders stay abreast of legal requirements and promptly address any issues that may arise. This proactive approach helps mitigate legal risks associated with non-compliance.

Adapting to Regulatory Changes: The legal landscape surrounding mortgage underwriting is subject to continuous change. Attorneys guide lenders through evolving regulatory frameworks, ensuring that automated systems remain compliant with new laws and regulations. This adaptability is essential for navigating the dynamic legal environment.

In conclusion, as mortgage loan underwriting embraces automation, attorneys serve as guardians of legal integrity, safeguarding borrowers’ rights and ensuring fair and transparent lending practices. By addressing compliance, transparency, data privacy, and other legal considerations, attorneys play a pivotal role in shaping the ethical and legal framework of automated underwriting systems, fostering a balance between efficiency and the protection of consumer rights.

Leave a Reply