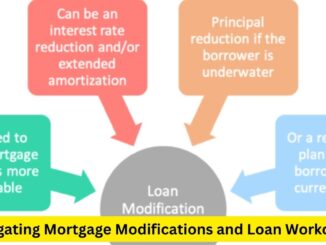

Navigating Mortgage Modifications and Loan Workouts: A Borrower’s Guide

In times of financial hardship or unexpected challenges, homeowners might find it difficult to meet their mortgage obligations. Mortgage modifications and loan workouts serve as […]